Better efficiency, more revenue opportunities, and increased customer lifetime value are just some of the benefits that financial services businesses can gain from investing in customer engagement. We’ll explore the current state of customer engagement in financial services and proven strategies for creating a customer-first approach that boosts your profits.

Contents

Key Takeaways

-

Customer engagement directly impacts retention, loyalty, and revenue growth in financial services. Engaged customers stay loyal and refer others.

-

To stand out, financial businesses must deliver personalised experiences, proactive engagement, and value beyond just transactions.

-

Understanding the customer journey allows for optimising engagement at each touchpoint. Personalising experiences based on customer needs is crucial.

-

Providing cross-channel support (phone, email, chat, social media, etc.) lets customers get help how and when they prefer.

-

Leveraging multiple marketing channels (email, social, and mobile ads) improves brand awareness and campaign effectiveness through targeted communications.

-

A mobile-first engagement strategy using push notifications, in-app messaging, and mobile wallets meets growing customer expectations.

-

Real-time data enables segmentation for timely, personalised engagement based on customer behaviours and needs.

-

Strategic brand partnerships through loyalty programmes add value beyond core financial services to drive memorable experiences and emotional connections.

Why is Customer Engagement Important?

Prioritising customer engagement is a must for financial services organisations because it has a direct influence on customer retention, loyalty, and revenue growth. Engaged customers are more likely to buy from a company again and recommend it to their friends and family, which can open up exciting business opportunities.

Even as the widespread adoption of digital technologies increases, sustained growth in the financial services industry still relies heavily on customer engagement. The shift towards digitisation could even supercharge customer engagement strategies.

However, there remains a need to balance the demand for digital solutions with a robust customer-centric culture.

The Role of Customer Engagement in Financial Services

Keeping a customer engaged means maintaining contact with them outside the sales cycle. This may be through personalised ads and promotions or even ongoing customer support. The goal is to show your company's dedication to the customer's needs and the value it provides over time to earn the customer's trust and loyalty.

According to recent studies, a company's most profitable customers are those that have a thorough understanding of the product and are actively engaged and connected to the brand.

Standing out in the modern marketplace by engaging customers

In the current economic climate, financial services businesses must prioritise customer engagement to stand out from the competition. A growing number of insurers, banking giants, and other financial businesses are implementing innovative customer engagement strategies.

In the UK alone, over 94% of businesses investing in digital customer engagement have experienced average revenue growth of 107%.

Brands in the financial services industry must hijack this trend to meet growing customer expectations. This means matching the level of privacy, flexibility, value, trust, and personalised service they have come to expect.

Financial services businesses must continuously deliver value beyond the initial transaction. You can do this by engaging customers through their financial journeys and using creative strategies to optimise their experience. This is crucial for gaining their long-term loyalty and thriving during the cost-of-living crisis and the development of new payment options.

According to Gallup's findings...

Banks receive 37% more yearly income from engaged customers than from actively disengaged ones.

This has the potential to amount to significant sums, making it imperative to foster customer interaction during every stage of the customer lifecycle.

Proactive customer engagement is on the rise - What is missing?

Financial services businesses have invested heavily in digital and analytics solutions in recent years to enhance customer experiences across mobile and web platforms. Banks have invested in technology, but many still aren't as good as consumer-tech businesses at attracting and retaining customers.

Existing customer acquisition and service delivery practices in the financial services and banking industry are overrun by missed opportunities for improvement. Many frequently fail to identify and act on the cues left by customers along their digital journeys.

However, leaders in providing engaging experiences across sectors are doing more than simply making the customer journey easy to navigate. They are also tailoring processes and interactions to match individual contexts, patterns, and needs. This creates a more memorable experience for customers and increases the value they receive.

Back to contents

Proven Strategies for Improving Customer Engagement in Financial Services

Businesses can no longer get away with simply reducing prices to retain customers. Financial organisations, now more than ever, must prioritise memorable engagement strategies. Here is a rundown of some of the best approaches you can use to strengthen your relationship with customers and boost sales.

1. Loyalty & Reward Programmes Featuring Closely Aligned Brand Partners

A loyalty and reward programme is a key driver of customer engagement for financial services businesses. You can increase your visibility, provide more value to your customers, and develop loyalty through strategic partnerships.

Partnerships don’t have to be limited to brands in the financial space alone. You can partner with retailers to offer your customers discounted pricing on their products when they use your service.

Boosting customer engagement with a loyalty and reward programme

Barclays, a British multinational investment bank and financial services provider, launched a loyalty programme that gives customers up to 10% cash back at more than 150 retail partners. It has built a system that gives its customers more value beyond its banking services.

Not only does this loyalty programme encourage users to make purchases using their Barclays accounts, but it also allows customers to interact with a larger variety of brand products and services.

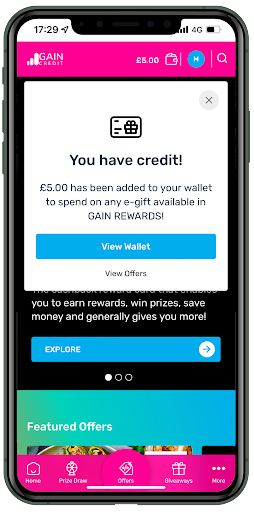

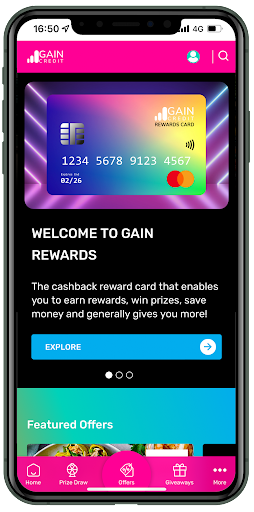

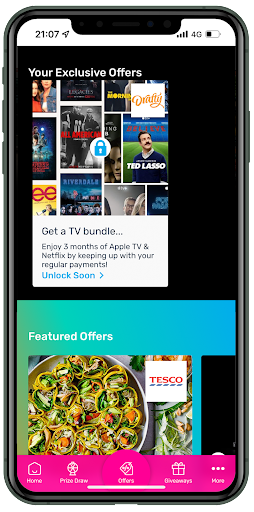

Similarly, Gain Credit, a financial services company and Propello client, has found success by forming partnerships with more than 200 businesses to provide customers with incentives, rewards and prize draws. Gain Credit provides more value to its customers by diversifying its offerings, while its partners can reach a larger demographic.

The combination of a customer-focused culture and the digital transformation sweeping the industry presents a unique opportunity for financial service providers. Those that manage to strike a good balance between these two elements will have the best chance of succeeding in what has become a highly competitive market.

Launching a loyalty and reward programme is a great way to combine an enhanced digital experience with a customer-focused culture to drive engagement and sustained growth for your business. This forward-thinking approach paves the way for deeper connections with customers and more memorable experiences.

How do partnerships within loyalty programmes work?

Many financial service providers employ this engagement strategy through loyalty programmes aimed at resolving pressing customer needs. This includes everything from managing their finances to promoting social responsibility and saving for retirement.

Remember that in the financial services industry, customer loyalty is about more than simply making a sale; it's also about connecting with customers on an emotional level and earning their trust. Partnering with other brands gives customers something to look forward to beyond the financial solutions you provide. This creates memorable experiences that extend your interaction and connection with customers beyond their financial needs.

Loyalty programmes create a reward structure that you can exploit to add value to your relationships with customers and increase their engagement with your brand.

Over 84% of consumers will stay with brands offering a loyalty programme.

Launching a programme also helps you learn more about your customers, which in turn allows you to improve your offerings and your overall marketing.

Download our guide to learn how to monetise your financial services loyalty & reward programme while engaging and retaining customers

2. Understand the customer journey

Financial services businesses must understand the customer journey to effectively engage customers. As they progress from prospect to paying customer, the journey prioritises the customer’s overall perception of your brand as opposed to the number of sales recorded.

Every point of contact between the consumer and your business is included in the customer journey, from the first point of contact through after-sale support.

You can learn more about your customers' needs as well as what resonates with them at key junctures in the customer journey. With this information in hand, you can design more effective campaigns and provide consumers with more personalised experiences that are sure to win their loyalty.

Create a customer journey map by analysing your interactions with your customers, from the pre-purchase research phase through the after-sale support phase. This gives you an idea of the customer's needs, satisfaction levels, and expectations.

After mapping out the customer's journey, optimise your engagement with them at each touchpoint along the way. For instance, you can support customers during the research phase by providing tools and resources that could help them make informed decisions about their finances.

In the buying phase, optimise the customer experience by providing transparent communication, user-friendly resources, and personalised deals. After a customer makes a purchase, offer them ongoing support, relevant recommendations, and loyalty rewards.

Back to contents

3. Personalised customer experience

It's clear that modern customers expect more relevance from their preferred brands. Personalising engagements builds trust and enhances the brand's reputation among customers.

UK consumers will spend over 15% more if a brand personalises engagements.

Businesses go on to report that consumer spending increases by 41% with personalised engagement. An overwhelming majority (72%) from another study considered personalisation "highly important," while only 8% disagreed.

Customers have unique needs. So it’s little wonder that everyone loves an experience that is tailored to their needs and makes them feel special.

Where are financial services businesses going wrong with personalisation?

Banks often approach customer experience optimisation as a series of random customer problems that need to be resolved. However, adopting such a narrow focus on the customer experience results in ineffective solutions that fail to address the underlying causes of customers' complaints.

The best strategy for improving the customer experience is to take a holistic view of the customer's interactions with the business. This means considering the sum of the customer’s expectations, whether while making a purchase or seeking a solution to a problem.

It’s not about sales or satisfaction scores alone, your efforts should aim to get the most out of each interaction. You can achieve this by understanding what your customers expect when they use your services and what it takes to deliver an exceptional experience.

The good news is that financial providers are rising to the challenge with creative solutions. Industry leaders like Barclays (Blue Rewards) and CitiBank (ThankYou Rewards) have used financial services loyalty programmes to deliver hyper-personalised experiences to their customers. This trend looks set to continue due to the high potential loyalty programmes have for improving engagement and supporting personalisation.

Back to contents

4. Cross-channel support

In the financial services sector, cross-channel customer support has become the standard that customers have come to expect.

78% of consumers would remain with their current bank if it provided personalised support.

Each customer has unique support requirements, and they expect brands to deliver that support through their preferred channel.

These channels include but aren’t limited to phone, email, in-app, live chat, social media, and other self-service channels. The best option will depend on the customer. Studies have shown that while 37% preferred chatbots or SMS communications, 63% said they would prefer to speak with a human bank representative directly.

The support financial providers offer must evolve to match changing customer demands. For instance, due to the present cost-of-living crisis, many Brits are reevaluating their financial plans and making necessary adjustments. A poll found that 35% of respondents are dissatisfied with the present budgeting and spending support they have access to, suggesting that banks should be doing more to support them.

This is an excellent example of issues that cross-channel support can resolve. By treating the customer journey as a single transaction consisting of several multi-channel interactions, you can always give customers the support they need when and how they need it.

Customers get a better experience when they can communicate with your business through their preferred channel and receive prompt, effective support. Some financial service providers are using AI and chatbots to offer real-time support to their customers across multiple channels. AI-powered chatbots resolve routine customer issues and complaints, freeing up resources for more important issues.

Back to contents

5. Leverage multiple marketing channels

Much like offering support, a multi-channel approach to marketing can drive customer engagement. Multi-channel marketers will often coordinate their efforts across many platforms to reach a wider audience.

This strategy exploits the advantages of individual distribution channels to emphasise the value of a financial product or service. Email, social media, mobile, and display ads are all examples of such channels. Leveraging these channels helps you deliver targeted communications and promotions.

While public-facing social media platforms remain useful tools, an increasing number of banks, fintech providers, and insurers use email to reach their customers with product updates, promotional offers, and even newsletters. Your financial newsletter could include several marketing assets, such as thought leadership articles, to engage your customers.

You can improve brand awareness and customer engagement by using multiple marketing channels to reach customers at different stages of the customer journey. It also allows you to reach more people with your marketing and improves the effectiveness of your campaigns by allowing you to target specific customer segments.

Back to contents

6. Mobile-focused engagement strategy

About 35% of customers currently use both a physical and a digital bank account. This is direct proof of the growing popularity of fintech providers and how they are influencing customer expectations. Financial service companies are adopting a mobile-first approach to customer engagement to meet this demand, and the results favour the argument for a better mobile experience.

For instance, leading financial service providers use mobile push notifications 48% more than their less mature counterparts. Mobile push notifications offer real-time interaction, personalised messaging, and conversion opportunities. They are a useful tool for businesses in the financial sector, whether it’s to remind customers of upcoming payments, promote financial products, or offer personalised financial guidance.

One study found that businesses can get a 190% boost in their 90-day app retention rate by using push notifications.

When it comes to mobile engagement, successful financial service providers also use strategies like in-app messaging and mobile wallets. These strategies can provide customers with a memorable mobile experience and useful tools for managing their finances, wherever they may be.

Customer reliance on mobile devices for financial management is increasing the need for mobile engagement. Boost customer engagement and drive brand loyalty and business growth by embracing a mobile-focused engagement strategy.

Back to contents

7. Utilising real-time data for data segmentation

More financial services businesses are using real-time data streams for segmentation, marketing, and analytics. You can create meaningful customer relationships and drive business growth by using always-on data to provide timely, personalised communications.

Real-time data streams offer valuable insights and support efforts to provide customers with a more personalised experience. You learn more about your customers' habits, likes, and dislikes, as well as their needs and expectations.

For instance, you can tailor email messages to individual customers based on their purchase history. Similarly, real-time data can help you provide real-time support to customers when they need it. An example could be offering an insurance package to a customer who just purchased a new home.

Regardless of how you use it, real-time data creates opportunities to add value to your relationships with customers.

Back to contents

Start Engaging Customers Today

The combination of a customer-focused culture and the digital transformation sweeping the industry presents a unique opportunity for financial service providers. Those who manage to strike a good balance between these two elements will have the best chance of succeeding in what has become a highly competitive market.

Launching a partnership programme is a great way to combine an enhanced digital experience with a customer-focused culture to drive customer engagement in financial services. This forward-thinking approach paves the way for deeper connections with customers and more memorable experiences.

Download our guide to learn how to monetise your financial services loyalty & reward programme while engaging and retaining customers

FAQs

What is customer engagement in financial services, and why is it important?

Customer engagement in financial services refers to interactions that build loyalty and retention, impacting customer satisfaction and your bottom line. Effective engagement keeps the customer happy and drives growth through word-of-mouth referrals and meaningful relationships with potential customers.

How can financial institutions leverage personalisation to improve customer engagement?

Financial institutions can use data analytics to offer personalised experiences, enhancing customer satisfaction and increasing customer retention. This helps deliver targeted marketing campaigns, ensuring the customer feels valued and understood, benefiting the business goals and bottom lines.

What role does technology play in enhancing customer engagement in the financial sector?

Technology enables digital engagement and automation in financial services, improving customer service and satisfaction. Mobile apps and data analytics provide real-time insights, enhancing the customer-centric approach. These tools offer a competitive advantage and optimise customer service teams' efforts.

How can financial services companies use data to create more personalised customer experiences?

Financial institutions can use data analytics to personalise customer experiences, increasing engagement and satisfaction. By understanding customer behaviour and preferences, they tailor their services, creating experiences that meet specific needs and drive higher retention rates and customer loyalty.

What are some best practices for implementing cross-channel customer support in financial services?

Effective cross-channel support can improve customer retention. Best practices include integrating communication channels like phone, email, chat, and social media. Customer support teams should use a knowledge base to provide consistent service, ensuring customer satisfaction and nurturing loyalty.

How can mobile-first engagement strategies benefit financial service providers and their customers?

Mobile-first strategies enhance engagement by meeting customer expectations for convenience. Banks and credit unions use mobile banking apps for real-time interactions and personalised experiences. This approach improves customer satisfaction and retention through seamless digital engagement.

What are the most effective ways to measure customer engagement in financial services?

Measuring customer engagement in financial services involves tracking metrics like net promoter score (NPS), customer satisfaction, and retention rates. Analysing data from customer service interactions and marketing campaigns reveals customer engagement levels and informs decisions to improve.

How can strategic partnerships enhance customer engagement for financial institutions?

Strategic partnerships enhance customer engagement by offering additional value and perks. Case studies show banks and credit unions partnering with retailers for loyalty programmes. Such collaborations give customers more reasons to engage via memorable experiences and unique offers from top brands.

What challenges do financial services companies face in improving customer engagement, and how can they overcome them?

Evolving customer expectations and the nature of financial products make it tricky for financial institutions to engage customers. The key to solving these challenges lies in strategies like loyalty programmes, which offer ongoing value and engagement via personalised offers and gamification.

How can financial institutions use gamification to increase customer engagement?

Gamification increases engagement by making financial interactions more enjoyable. Mobile apps can incorporate gamified elements, encouraging customers to use services frequently. Loyalty programmes can also offer gamified rewards via contests and prize draws to drive digital engagement and brand loyalty.

Author Bio, Written By:

Mark Camp | CEO & Founder at PropelloCloud.com | LinkedIn

Mark is the Founder and CEO of Propello Cloud, an innovative SaaS platform for loyalty and customer engagement. With over 20 years of marketing experience, he is passionate about helping brands boost retention and acquisition with scalable loyalty solutions.

Mark is an expert in loyalty and engagement strategy, having worked with major enterprise clients across industries to drive growth through rewards programmes. He leads Propello Cloud's mission to deliver versatile platforms that help organisations attract, engage and retain customers.

.png)