Customer loyalty is the foundation of any successful business. This is even more true for businesses in the financial sector. Creative strategies like financial services loyalty programmes make a difference for businesses looking to thrive in the industry.

In this article, we’ll cover the following:

-

Different Types of Loyalty Programmes Used by Financial Services

-

Best Practices for Creating Successful Financial Services Loyalty Programmes

-

Examples of Loyalty and Reward Programmes in Financial Services

-

Overcoming Challenges and Ensuring Loyalty Programme Success

Key Takeaways

-

Around 90% of businesses reward devoted customers through loyalty programmes.

-

Financial service loyalty programmes help businesses encourage repeat business, attract new customers, and enhance user engagement.

-

Loyalty programmes offer several benefits, including increased customer retention, engagement, competitive advantage, and valuable data insights.

-

Common types of loyalty programmes in financial services include points-based, tier-based, cashback, partner, referral, and gamification programmes.

-

Best practices for creating successful loyalty programmes involve aligning with customer needs, designing engaging experiences, choosing the right rewards, and measuring performance.

-

Over 75% of people are willing to invest in mobile-friendly loyalty programmes, highlighting the importance of accessibility.

-

Examples of successful loyalty programmes include Club Lloyds, Bank of America's Preferred Rewards, American Express Membership Rewards, and Citi ThankYou Rewards.

-

By offering personalised, accessible, and socially responsible loyalty programmes, financial services businesses can foster customer loyalty and achieve sustained growth.

Technology continues to redefine the world of business, influencing financial service businesses and the products that they provide. Innovative solutions like mobile and digital banking set the standard for convenient, personalised, fast, and user-friendly customer service.

Customers expect nothing short of this tailored approach that targets their pain points and enhances the overall user experience. The modern marketplace offers customers more freedom of choice as financial service providers struggle to meet these ever-changing consumer demands.

Financial services loyalty programmes are exactly what modern businesses need to get an edge over the competition and drive customer engagement

About 90% of businesses reward devoted customers via a loyalty programme. (zippia)

Loyalty programmes improve the value that your customers get from your services. It’s an effective technique for increasing customer retention and reducing customer churn. It also drives business growth and enhances the reputation of your business.

What is a Financial Service Loyalty Programme?

Financial service loyalty programmes help businesses reward and encourage repeat business from their customers. It is a form of incentive marketing that builds trust and loyalty between a business and its customer base.

Customers receive extra benefits and value beyond their original purchase via incentives such as discounts or gift cards.

Credit card rewards programmes, airline mile programmes, and banking and investment service loyalty programmes are all excellent examples. Customers who participate in these programmes enjoy perks like free flights, discounted prices, giveaways, and cash-back offers on their purchases.

Different Types of Loyalty Programmes Used by Financial Services

There are several loyalty programmes available to financial services businesses looking to attract new customers, retain existing ones, and improve user engagement with their products and services.

Here are some of the common approaches that financial services businesses use to create their loyalty programmes:

Always On programmes featuring brand Partners

Always on programmes featuring closely aligned brand partner offers involve rewarding your loyal customers with exclusive partner offers that add additional value to their policy or financial product. This often means offering them a partner brand’s products and services at a discounted rate after they make repeat purchases.

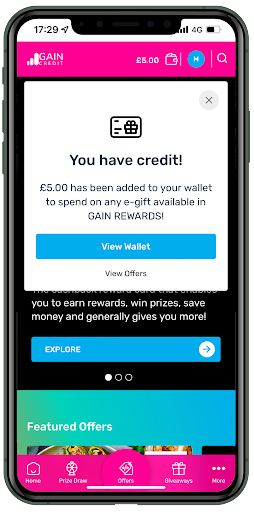

“GAIN Credit has been working with Propello to deliver exceptional value to our customers. With the cost-of-living crisis impacting everyone, we’re so pleased that we can offer even more ways for our customers to make real savings.”

Alex Woodcraft (Marketing Director) | Gain Credit

Cashback programmes

In these programmes, repeat customers are rewarded with a percentage of their spending. This could be in cash, deposited into their accounts, or store credit for future purchases.

Referral programmes

These programmes leverage the power of word-of-mouth marketing to increase your marketing reach and lead conversion rate. This approach can be a game-changer as over...

88% of people trust referrals made by friends and family over other marketing channels.

In referral programmes, customers are rewarded for each lead or referral they bring in. A popular example includes fintech apps that give an existing customer a unique code to invite friends and family to sign up. Customers earn monetary rewards or special deals when leads sign up with the code and meet the minimum engagement or spending limit.

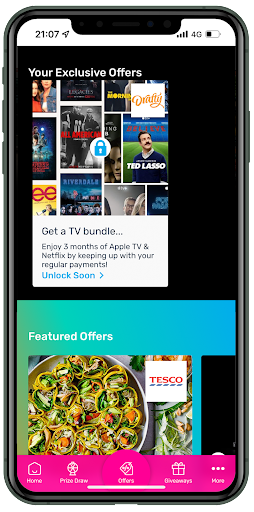

Gamification programmes

Gamification is an innovative technique that can supercharge your loyalty programme. Customers complete gamified challenges and tasks (possibly related to financial literacy) to gain access to rewards and climb up the loyalty ladder.

Reports suggest that businesses that use gamification to engage customers enjoy a 22% increase in brand loyalty and a 47% increase in brand engagement.

It’s important to note that while each of these approaches has its benefits, there are potential downsides. You must carefully consider the options to choose the one that best meets your customers' needs and supports your business objectives.

Your financial services loyalty programme must be aligned with your overall marketing strategy and offer customers real value. It must be reviewed and revised regularly to ensure that the programme remains relevant and effectively supports your customer retention strategy.

Points-based programmes

In this approach, customers earn points after each purchase. Once they’ve earned enough points, they can redeem them for discounts, freebies, or other types of rewards.

Tier-based programmes

This system involves grouping customers into tiers or levels with unique benefits. The customer’s engagement and purchase history will determine which tier they fall into. High-tier customers get better offers, such as priority customer support, exclusive event access, or personalised offers.

Best Practices for Creating Successful Financial Services Loyalty Programmes

In addition to the steps above, when designing and implementing your programme, there are some other important factors to integrate into your plan:

1) Choosing the right loyalty programme rewards and benefits

The rewards you offer will often make or break your loyalty programme. Here are some tips to help you make the right choices.

-

Provide financial and experiential rewards: Reinforcing behaviours with financial incentives – such as cashback or discounts – offers distinct value that saves customers money. But experiential bonuses – such as exclusive events or travel perks – create memorable experiences that connect customers to your brand.

-

Form partnerships: Partner with complementary brands to provide rewards that resonate with customer interests and lifestyles. Partnerships encourage customers to spend more, improve programme value, and create opportunities for customer acquisition and cross-promotion.

-

Reward relevance and aspirational value: Rewards must be relevant to each customer’s interests and needs. Aspirational rewards, such as luxury experiences or exclusive access to events, can motivate your target audience to engage more with the programme.

2) Personalisation

This is a powerful technique for increasing customer satisfaction and engagement with your programme.

Studies have shown that only 2 in 10 members of loyalty programmes are completely satisfied with the brand’s approach to personalisation.

Meanwhile, customer satisfaction can increase by as much as 6.4x when personalisation is properly implemented.

Analyse customer preferences and behaviour and use that information to personalise rewards and product recommendations to meet their present and future needs.

3) Make it engaging and user-friendly

Here are some helpful ideas to improve engagement and accessibility in your loyalty programme.

Simplifying programme enrolment and reward redemption processes

Simplifying programme enrolment and reward redemption processes is crucial to encouraging participation and maintaining customer satisfaction. By streamlining these processes, potential customers are more likely to join the programme and remain active participants.

Leveraging mobile app integration and digital wallets for convenience

Did you know that over 75% of people are willing to invest in mobile-friendly loyalty programmes? Customers expect easy access in real time across multiple channels that provide a more user-friendly experience.

This accessibility should cut across mobile apps, digital wallets, online banking platforms, and even physical locations for the complete omnichannel experience.

Focusing on engagement and accessibility can lead to increased customer spend, improved customer retention, and ultimately a positive impact on your bottom line. A user-friendly loyalty programme also provides valuable data insights, allowing you to tailor marketing campaigns and customer service teams to serve customers better.

4) Transparency

Your loyalty programme must have clear and concise terms and conditions. Transparency is vital to keeping customers informed on how to earn and redeem rewards. Ensure that you notify them about fees, restrictions, and possible reward expirations.

5) Social responsibility - ESG (Environmental, Social and Governance)

Consumers demand more from the brands they support and patronise. They expect their preferred brands to take a strong stance on several social issues.

This report found that:

42% of consumers want brands to address the climate emergency, with another 34% focused on poverty and inequality and 31% on racism.

You can support social responsibility by rewarding customers for eco-friendly behaviour. Another viable option is to partner with social impact organisations that address issues that are important to your customers.

6) Measuring and optimising loyalty programme performance

It’s essential to define a set of key performance indicators (KPIs) that correspond with the objectives of your financial services loyalty programme. These KPIs should be monitored and analysed regularly to assess programme effectiveness.

-

Customer engagement rates

-

Redemption rates

-

Customer lifetime value

-

Net promoter scores

-

Customer retention rates

-

New customer acquisition

-

Customer spend per transaction

-

Frequency of transactions

Another way to measure programme performance is to consider its return on investment (ROI). Comparing the costs with the benefits (such as higher customer spends and retention) reveals the programme's impact on your overall revenue and what changes should be made to optimise it.

Examples of Loyalty and Reward Programmes in Financial Services

Here are some real-world examples of loyalty programmes in the financial services industry.

Club Lloyds

Club Lloyds provides customers with fair value through exclusive perks and rewards that their customers simply can’t get enough of.

Exclusive discounts with partners:

-

Retail stores

-

Hotel chains

-

Airlines & more!

Special premium member perks such as:

-

Free travel insurance

-

Lower entry points for investment products

Special mortgage features range from offset savings costs to cash-back offers.

All of these lead to positive outcomes for customers.

Other programme features include:

-

Tiered rewards programmes, divided in: Classic, Silver Account and Platinum, each with their own rewards & benefits.

-

The rewards programme provides a seamless experience by linking cash back rewards to payment cards with selected retailers.

-

Roster of participating retailers include highly regarded brands that offset the cost of living (supermarkets, clothing & breakdown cover)

Bank of America's Preferred Rewards programme

This programme provides privileges with tiered benefits based on balances across accounts. Key features are:

-

Tiered Benefits: Gold, Platinum, Platinum Honours, and Diamond tiers are available, with more advantages accruing to customers as their account balances grow.

-

Upgraded Credit Card Rewards: A 25% to 75% bonus on credit card rewards, depending on the tier.

-

Other Perks: Reduced banking charges, higher interest rates on deposits, and lower mortgage rates.

-

Eligibility: Members must have an aggregate balance of at least $20,000 in Bank of America deposit accounts or Merrill investment accounts

Bank of America Preferred Rewards

American Express Membership Rewards

The American Express Membership Rewards programme is known for its flexibility and exclusive benefits. It features:

-

Flexible Point Redemption: Points can be redeemed for travel, shopping, and various experiences.

-

Exclusive Cardholder Benefits: Cardholders can access special events, experience premium concierge services, and enjoy private dining experiences.

-

Travel Perks: Members can transfer points into a wide range of air mileage and hotel loyalty programmes.

American Express Membership Rewards

Citi ThankYou Rewards

The Citi ThankYou Rewards programme focuses on accelerated point earning and unique experiences, featuring:

-

Accelerated Points: Earn points faster in specific spending categories, such as dining and travel.

-

Flexible Redemption Options: Points can be redeemed for travel, gift cards, merchandise, or transferred to airline partners.

-

Unique Experiences: Members enjoy access to private events and music and dining experiences tailored for loyal members.

These examples provide a sense of the scope and complexity of loyalty and reward programmes, each designed to offer unique perks and maintain customer engagement within the financial services sector.

Overcoming Challenges and Ensuring Loyalty Programme Success

Building a successful loyalty programme comes with its fair share of challenges. Here are some common challenges you might face and how to overcome them.

Addressing data privacy and security concerns

In the financial services sector, data privacy and security are a must. You must provide strong data protection via encryption, secure storage, and limiting access controls. Transparency in data collection and usage practices, along with clear communication with customers, can help build trust and alleviate concerns.

Maintaining programme simplicity and transparency

Maintaining simplicity and transparency is crucial to driving programme adoption and end-user engagement, as overly complex rules and redemption processes will affect participation.

Your goal in rolling out a loyalty programme should be to simplify the value proposition for customers. Make it easy to join and stay engaged.

Continuously innovating and adapting to market trends

Your loyalty programme has to evolve along with changing financial services trends. Technologies, such as AI and machine learning, continue to redefine how businesses personalise experiences and rewards.

You should routinely track industry best practices and consumer preferences. Be among the first to deliver what loyal customers want before they start chasing deals elsewhere.

Integrating loyalty programmes with overall financial services marketing strategies

Loyalty programmes exist to align with – and support the values of the parent brand, the segmentation of the core audience, and the business goals.

In particular, by merging loyalty programme messaging and benefits into your broader marketing campaigns, you can elevate the customer experience to be more cohesive and mutually reinforcing, creating the kind of consistency that drives long-term loyalty and profit.

Customer Loyalty & Increased Retention is the Key to Sustained Business Growth

In the modern age, where customers now have several financial service options at their fingertips, customer loyalty is more important than ever.

Create meaningful relationships with your customers by understanding their behaviours, preferences, and needs and offering them a robust loyalty programme that is aligned with those needs.

Financial services loyalty programmes with personalised rewards, tiered benefits, and seamless access across multiple channels, promote customer loyalty and sustained growth for your business.

FAQs

What are the primary benefits of financial services loyalty programmes?

Financial loyalty programmes offer rewards, discounts, and exclusive benefits, encouraging repeat business and boosting customer retention. They provide insights into customer behaviour and preferences, allowing financial institutions to personalise their services and improve customer satisfaction.

How do financial services loyalty programmes work?

Customers earn points, miles, or cashback for using the institution's products or services. These rewards can be redeemed for various benefits, such as discounts, gift cards, exclusive experiences, and more. The more customers engage with the financial institution, the more rewards they earn.

What types of loyalty programmes are commonly used in the financial sector?

Common loyalty programmes in the financial sector include points-based systems, tiered membership levels, co-branded credit cards, and partnership programmes. These programmes are designed to incentivise customers to use the institution's services more frequently and maintain long-term relationships.

How do loyalty programmes enhance customer engagement?

Loyalty programmes enhance customer engagement by providing incentives for customers to interact with the institution regularly. By offering rewards and personalised experiences, financial institutions can create an emotional connection with customers, leading to increased loyalty and advocacy.

What are the best practices for creating a successful loyalty programme?

Best practices for creating a successful loyalty programme include understanding customer preferences, offering meaningful rewards, simplifying the redemption process, regularly communicating with members, and continuously analysing and refining the programme based on customer feedback and data insights.

Why is personalisation important in loyalty programmes?

Personalisation shows the customers that the financial institution values and understands their unique needs and preferences. By tailoring rewards, communications, and experiences to individual customers, financial institutions can build stronger relationships and increase customer satisfaction.

How do loyalty programmes provide valuable data insights?

Loyalty programmes generate valuable data on customer transactions, preferences, and behaviour. Analysing this data helps identify trends, segment customers, and develop targeted marketing campaigns. Institutions can also use these insights to improve their products and services to meet customer needs.

What challenges do financial institutions face when implementing loyalty programmes?

Challenges faced by financial institutions include integration with existing systems, ensuring data security and privacy, managing programme costs, and maintaining programme relevance and value to customers over time. They must also navigate complex regulations and compliance requirements.

How can financial services loyalty programmes be made more accessible to customers?

Financial services businesses can make their loyalty programmes more accessible by offering several redemption options, providing clear and concise programme information, and ensuring easy enrolment and participation across multiple channels, such as online, mobile, and in-person.

What are some examples of successful loyalty programmes in the financial services industry?

Examples of loyalty programmes in financial services include American Express Membership Rewards, Chase Ultimate Rewards, and Bank of America Preferred Rewards. They offer a wide range of redemption options, personalised benefits, and seamless integration with the institution's products and services.

Author Bio, Written By:

Mark Camp | CEO & Founder at PropelloCloud.com | LinkedIn

Mark is the Founder and CEO of Propello Cloud, an innovative SaaS platform for loyalty and customer engagement. With over 20 years of marketing experience, he is passionate about helping brands boost retention and acquisition with scalable loyalty solutions.

Mark is an expert in loyalty and engagement strategy, having worked with major enterprise clients across industries to drive growth through rewards programmes. He leads Propello Cloud's mission to deliver versatile platforms that help organisations attract, engage and retain customers.

.png)