Across the insurance industry there's trends that are shaping the way companies are securing long-term customer loyalty. Many of the trends we're about to discuss are direct responses to the rapidly changing expectations of insurance customers, risk models impacted by climate change, and new, disruptive players challenging traditional insurance models. The status quo is quickly shifting.

However, amidst these challenges there's a golden opportunity, one that intelligent insurance leaders could use to reset relationships with their customers built on trust, empathy, and shared value. In this article, we're giving you the fundamental trends that if implemented today could beckon a new era of unprecedented customer loyalty for your insurance company.

|

Written by: |

In this Article...

| Strategies for implementing trends for success |

| Examples of insurance companies implementing trends |

| Embracing change for a customer-centric future |

| FAQs |

Key Takeaways

|

The insurance industry is currently facing challenges from changing customer expectations, macroeconomic pressures, and new regulations. |

|

|

|

Insurers must navigate emerging risks and losses, macroeconomic factors, changing customer preferences, regulatory pressures, and the growing importance of sustainability. |

|

|

Key trends shaping the industry include the shift to customer-centric business models, growth through strategic loyalty partnerships, adoption of advanced technologies, AI advancements, and workforce transformation. |

|

|

Strategies for success include personalising customer experiences through data analytics, harnessing data and AI for operational efficiency, and embedding sustainability into business strategies. |

|

|

Examples of companies implementing these trends include Lemonade, Toffee Insurance, Inclusivity Solutions, MicroEnsure, and Smile, demonstrating the power of innovation and customer-centricity. |

Some of the key challenges and opportunities for insurers are analysed in our 2025 Loyalty Uncovered report.

What are the Challenges Facing the Insurance Industry?

Most, if not all companies in the insurance sector will be familiar with several challenges around customer loyalty and retention. Many of these are the result of a constantly evolving landscape, as well as the shifting expectations of modern customers. The sector has also seen an increase in regulations that have disrupted acquisition-led models. Let's take a look at these in greater detail:

Macroeconomic Factors

Today's economic climate of rising inflation and interest rates forces many insurance companies to pass the extra cost onto customers. As a result, customers upset with an increase in their premiums look elsewhere for a better deal. It's a catch-22 scenario. Insurance companies can't be expected to retain the customers who they pass the extra cost on to. And there lies the problem. Instead of securing retention, insurers secure the opposite; annual churn. |

Changing Customer PreferencesGone are the days of a product or service fully satisfying customers. In this digital era, customers have grown accustomed to a world of personalisation, convenience and seamless experiences. What they receive in one sector, they have come to expect in other sectors including the insurance industry. To stay competitive, insurers must adapt. |

Regulatory Changes and Compliance PressuresIn the UK we saw the introduction of the FCA's 2022 Consumer Duty. This was mainly a crackdown on pricewalking. At first glance, these stricter regulations may be perceived as an extra hurdle to jump, given that they disrupt governance and potentially lead to high compliance costs. Which would only serve to further exacerbate the challenge of delivering competitively priced products. |

What are the Key Trends Shaping the Insurance Industry?

With full context of the challenges the industry is facing, we can begin to understand the reason why certain trends are emerging. Below are 8 industry trends that are shaping the insurance industry in 2025.

1) Shift to Customer-Centric Business ModelsThe majority of customers still resort to cancelling policies. In the UK, 1.3 million car insurance policies are cancelled each year. As higher interest rates hit, this staggering number is set to increase. Inflation is hitting vehicle insurance more acutely than other sub-sector.

|

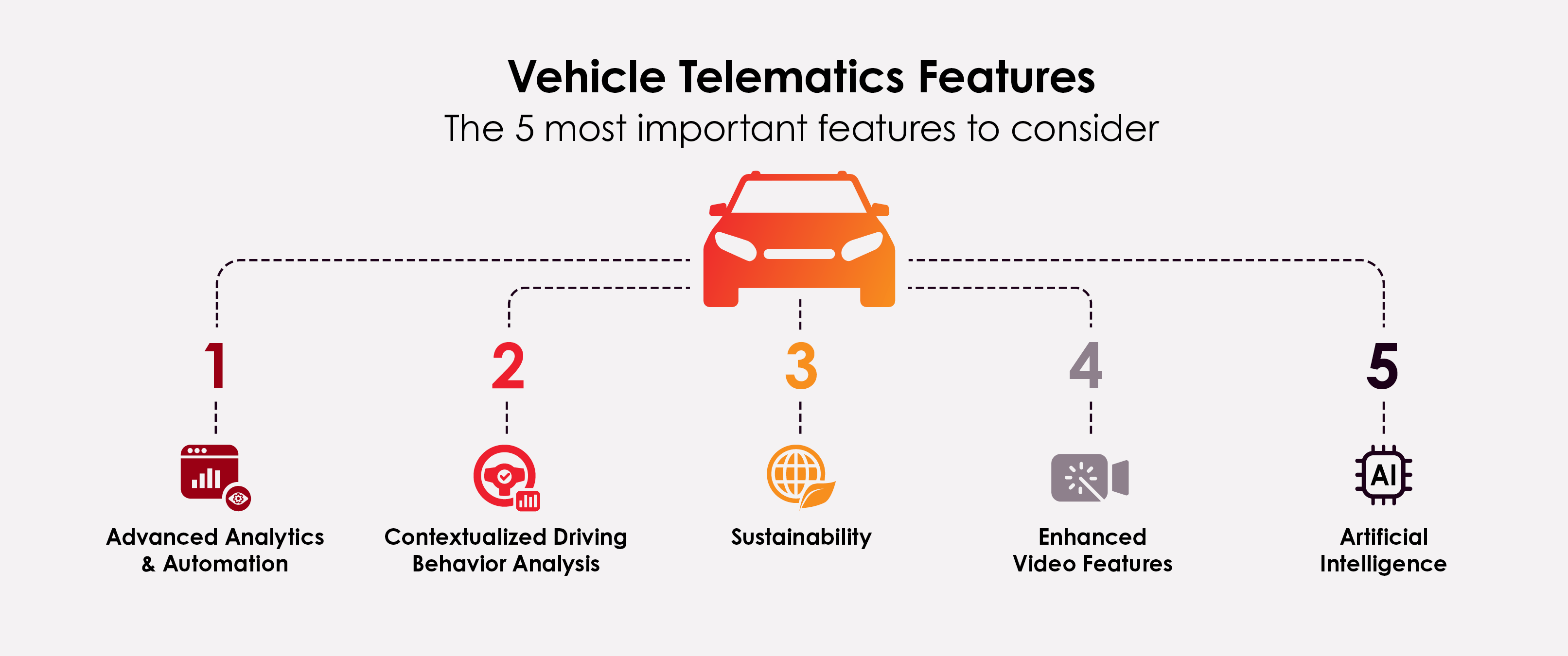

2) Leveraging Data and Insights to Deliver PersonalisationIn our 2025 Loyalty Uncovered Report, 83% of the insurers we spoke to said they were actively investing in data-gathering and improved personalisation. Telematics plays a major role in this. They allow insurers to track customer behaviour. Originally, this was to ensure customers adhered to their policy terms and demonstrated safe behaviours like driving responsibly. |

3) Rise in Telematics & Tech WearablesMost consumers are familiar with telematics. Insurers use it to personalise rewards using live data from black boxes. But what if it goes beyond personal driving behaviours? The advent of smartwatches and other wearable devices has revolutionised the way insurers assess risks and track their customers to gain and enrich customer data.

Source: Tourmo

Insurers can use driving behaviour analysis to reward customers for responsible behaviour while keeping insurance premiums fair. This also encourages retention and increases lifetime value for the insurer. |

4) Investment in Strategic PartnershipsOne of the most exciting opportunities we've identified is the potential for strategic loyalty partnerships to create unique, highly relevant rewards that resonate with insurance customers. In fact, in our 2025 Loyalty Uncovered Report, the insurance industry was the second highest investor in brand partnerships after retail. An overwhelming 86% of insurers have or are planning to invest in brand partnerships.

We’ve already seen some insurers drive growth and innovation by embracing industry convergence and embedded insurance. Bundling insurance products with other complementary services helps insurers reach new customers and create integrated experiences. Innovative partnerships are the next natural step. |

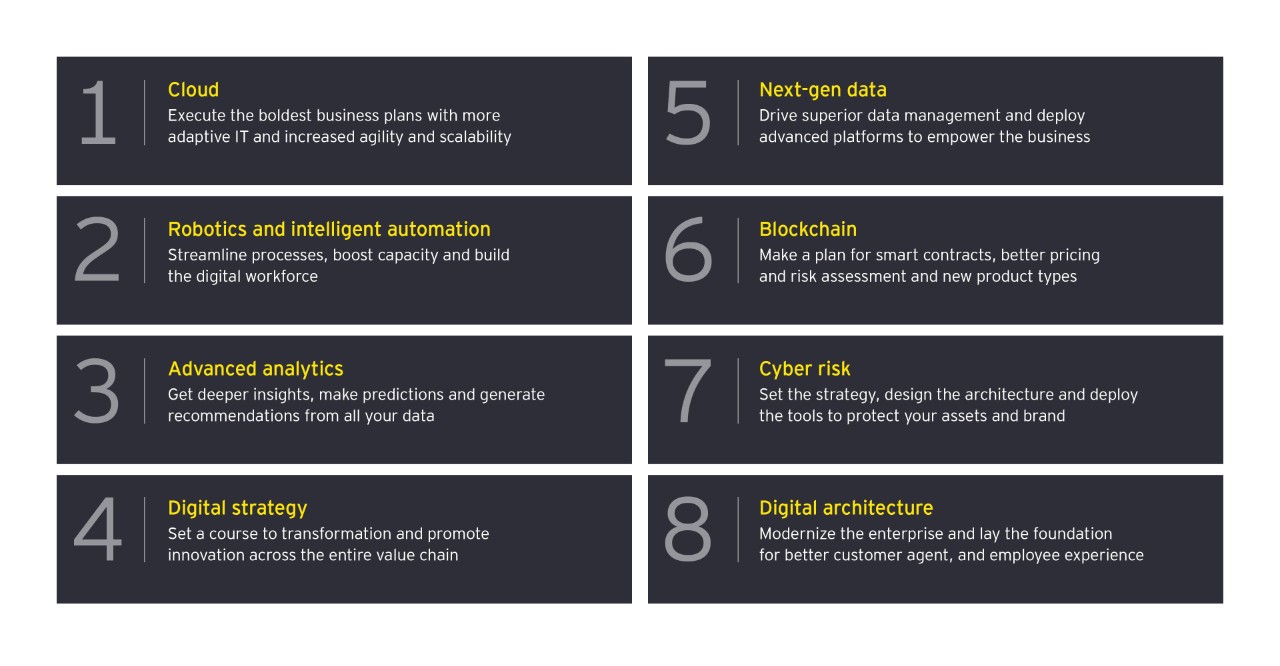

5) Increased Digitalisation and Connected TechnologyWith greater personalisation and omnichannel support in play, it's natural to see further progression towards digitalisation and connective technology. To meet the expectations of the modern consumer insurers need the right digital tools and platforms for streamlining operations, reducing their costs, and enhancng the overall customer experience.

Summary of digitalisation in insurance: EY

Let’s not forget the role of APIs that allow for seamless integrations. APIs have paved the way to leverage real-time customer data between platforms, in order to deliver cohesive personalised experiences. Reward programmes use CRM data and the customer insights it reveals to shape hyper-relevant reward offers that incentivise policy renewals. No wonder from the insurers that we spoke to 77% are currently investing in this area.

There's also a case for adopting digital channels like online portals and mobile apps. They are a great fit for giving insurance customers exactly what they want; self-service. These channels allow customers to:

Self-service tools build on the positive impact that no-code solutions and API applications have on businesses. They free up agents from having to deal with queries or generating quotes. And for the customer, it delivers a quick and convenient experience.

With larger datasets comes the need for robust cybersecurity measures. Insurers who collect, store and share vast volumes of sensitive data in third party platforms, must invest in capable security solutions. These safeguard customer data against cyber threats which is essential for a trustworthy brand reputation.

Artificial Intelligence As digitalisation and connected technologies reshape insurance, artificial intelligence is becoming a key solution for many companies. This is due mainly to its capabilities in automating routine processes and analysing real-time data from wearables and telematics. AI also speeds up decision-making and adds depth to personalisation efforts. Its growing role will be explored in more detail in the following section. |

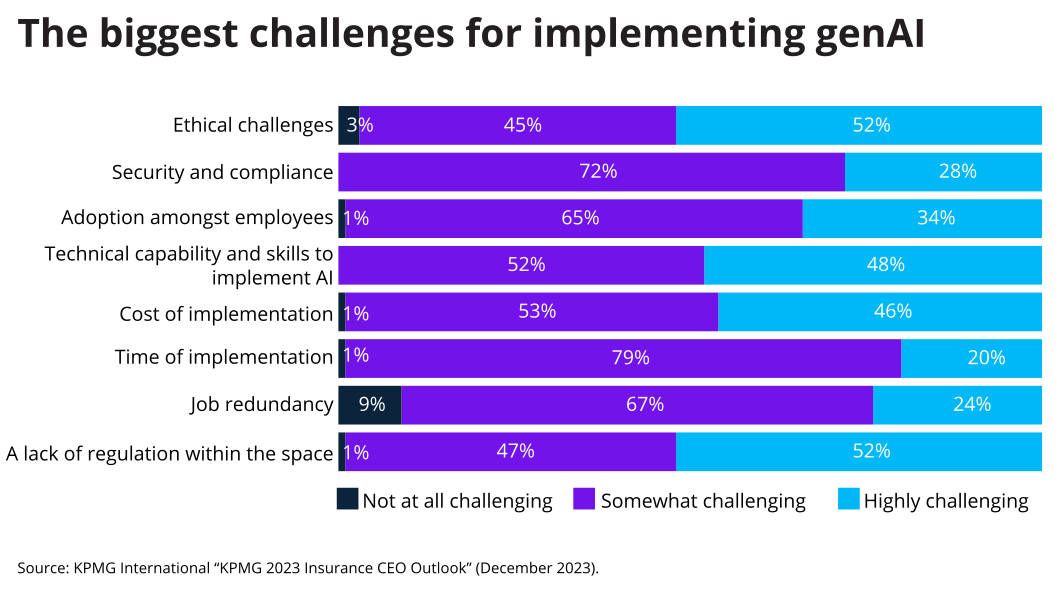

6) Artificial Intelligence (AI) AdvancementsWhilst part of ongoing digitalisation, artificial intelligence remains unprecedented in terms of its innovation. For that reason alone it deserve its own section. It has revolutionised most sectors, the insurance sector included, enhancing underwriting, claims management and customer service. Generative AI even informs product development, assists with marketing efforts and gives personalisation that extra edge.

|

7) Continual Focus on ESGSince 2020, the top 30 insurance firms have boosted their ESG rankings by an impressive 20 points. The momentum doesn’t seem to be slowing. While meeting regulatory standards is a big part of the push, many insurers are also thinking ahead, using ESG as a lens for shaping future governance and business practices. |

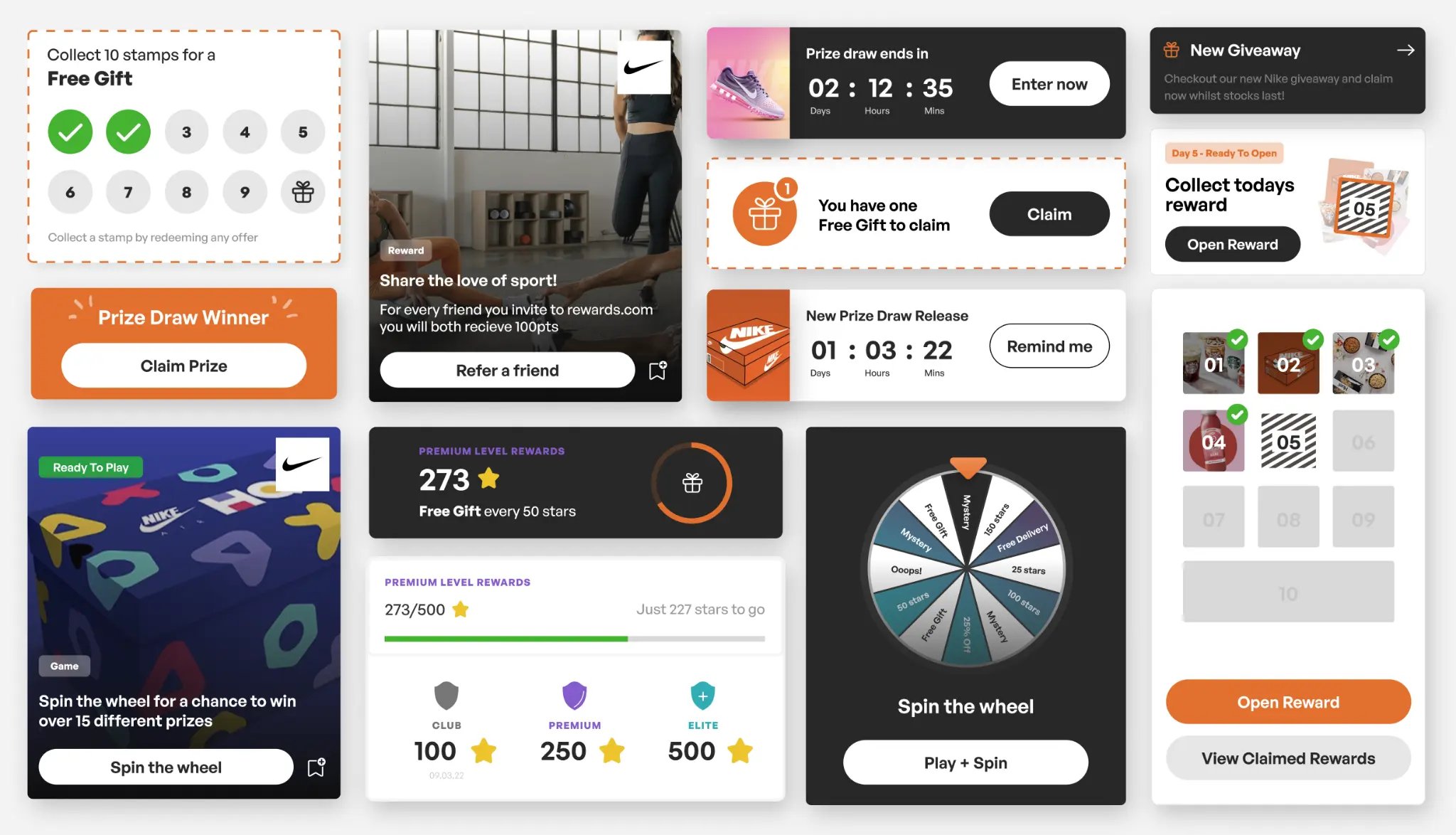

8) GamificationKeeping customers engaged between renewals has always been a challenge. In many cases, policies remain untouched for most of the year, with little interaction unless a claim is made. But in the modern insurance industry, engagement should definitely not be limited to the point of purchase.

|

Strategies for Implementing Trends for Success

We've gone through several trends but a full explanation of how to implement probably requires its own full article. Stay tuned for that. It's on its way. For now, we've selected the 3 most pressing trends that we think you should implement before the end of 2025. Here are the key areas to focus on:

Personalising the Customer Experience through Data Analytics

Personalisation boosts customer engagement and loyalty in the insurance industry because it gives the brand a way of speaking to individuals. Data analytics and customer segmentation are integral for achieving this feat. Without both, you won't be capable of effectively tailoring products, services and rewards content to individual needs, preferences and interests.

That's why our loyalty platform is designed to leverage the power of data and build detailed segmentation lists. It's a centralised hub for creating hyper-relevant experiences. You should consider a third party solution like the Propello platform because it's also able to integrate with your existing systems. It slots right in like a missing part in the puzzle, instantly providing advanced analytics. As a result, our insurance clients gain a clear view(and deeper insights!) into their customers' behaviour and preferences. Should you choose a software like ours, be sure to use the insights you gain to shape the personalised customer experience with your brand.

Harnessing the Power of Data and AI for Operational Efficiency

As we've seen, data and artificial intelligence (AI) are one of the top methods for boosting operational efficiency. AI automates core processes like underwriting and claims management.

Insurers should invest in modernising their legacy systems with a solution like the Propello loyalty platform. Third party solutions like Propello's come with AI capabilities. They add flexibility and scalability to existing infrastructures, streamlining the process of leveraging data without costly overhauls.

For whatever reason you may use data or implement AI, it must always be in the service of delivering an efficient, transparent service. One that makes customers feel valued and informed.

Embedding Sustainability into Your Business Strategy

Sustainability and social impact not only respond to the interests of certain demographics, they also serve as key differentiators for your brand. Since the modern consumers consistently seek out brands that align with their personal values, it's only right that insurers demonstrate shared values in their brand image and persona.

It has to be genuine though. Pick something from the environmental, social, and governance (ESG) principles that work well with your products and services. Show how by being a customer to your insurance business, customers are contributing to a positive force, driving change in the world. Trust is integral here as your customers will expect authenticity in your mission and commitment to society.

Examples of Insurance Companies Implementing Trends

Let’s take a look at some examples of insurance companies using loyalty programmes to deliver on some of the trends we’ve discussed.

|

Company |

Description |

Implemented Trends |

|

Lemonade |

InsurTech partnered with Allianz for expertise, scale, and reinsurance. Uses AI and ML for a customer-centric approach. |

|

|

Inclusivity Solutions |

South African micro insurance provider for low-income customers in Africa and Asia. Products: health, P&C, mobile phone and small business insurance. |

|

|

UK-based micro insurance company serving low-income customers in Asia and Africa. Products: health, P&C, mobile phone, and small business insurance. |

|

Smile

Traditional insurers like Smile are adapting to keep pace with tech-savvy InsurTechs and accessible micro insurance providers. They've embraced a customer-centric philosophy, focusing on seamless, personalised experiences.

CEO Pierangelo Campopiano says Smile has been dubbed the "Netflix of insurance."

Smile's loyalty rewards scheme is central to their strategy. The app-based programme offers points for safe driving, online shopping protection, and special offers from ecosystem partners. But their true innovation lies in their freemium business model.

.webp?width=2060&height=1060&name=Smile%20Insurance%20(1).webp)

Potential customers gain rewards before committing to full coverage, enjoying a taste of the experience. This builds emotional relationships and helps customers perceive the value they want. "Rather than our value proposition," Campopiano states, "we prefer to manage our value perception."

Smile's approach aligns with the trends we've discussed, as shown in the table above. They exemplify the shift towards customer-centric business models and the power of strategic loyalty partnerships. By prioritising customer needs and leveraging gamification and community building, Smile demonstrates how traditional insurers can innovate to stay competitive in the evolving insurance landscape.

Embracing Change for a Customer-Centric Future

As insurance industry trends continue to evolve, it's clear that embracing change is key to staying ahead of the curve. By staying attuned to the challenges and opportunities, and implementing the strategies discussed above, insurers can create a more customer-centric, resilient, and sustainable business model.

If you found this content useful and want to get some ideas about developing a customer-centric culture, download our guide + template.

FAQs

How is the insurance industry adapting to the changing customer preferences and expectations?

The insurance industry is shifting towards customer-centric models that are primarily focused on personalised experiences and using data analytics to effectively respond to customer needs. They are also adopting omnichannel support in order to amalgamate the overall customer experience into a single cohesive journey.

What role do strategic loyalty partnerships play in driving growth and innovation in the insurance industry?

Insurance companies that partner with complementary brands drive growth and innovation by co-creating unique value propositions. These often come as rewards that complement the core products and services of the insurance company or vice versa. This exposes each brand to the other’s audience.

How are insurance companies leveraging advanced technologies to streamline operations and enhance customer experiences?

Insurers adopt digital tools and third party platforms that streamline operations, reduce operational costs, and improve overall customer experiences. Often, these solutions are coupled with CRM systems. Together, they automate core processes like underwriting and claims management.

What impact are artificial intelligence (AI) advancements having on the insurance industry?

AI assists with underwriting, claims management, customer service, and enhancing loyalty initiatives. The latter in particular benefits from AI. Smart loyalty programmes assess data 24/7 and shape the best possible rewards experience for every individual customer.

How can insurance companies personalise customer experiences through data analytics?

Insurance companies can use a CRM or loyalty programme to personalise customer experiences. The latter can also be AI-led. Analytics at the back-end inform which rewards are best to offer the user at the front-end. Often these rewards are based on insights about individual behaviour and preferences.

Why is embedding sustainability into business strategies becoming increasingly important for insurance companies?

Younger demographics overwhelmingly prefer brands that align with their personal values or commit to social causes. As these demographics like Millennials age, car, home, pet or life insurance will become a necessity. Therefore, the insurance sector has to adapt to demographics that are becoming their core base.

What can insurance companies learn from the examples of Lemonade, Toffee Insurance, Inclusivity Solutions, MicroEnsure, and Smile?

Each of these examples are tangible proof of how the insurance sector is responding to changing circumstances. These insurers are prioritising customer-centricity through strategic partnerships, flexible services and technological innovation.

Author Bio, Written By:

Mark Camp | CEO & Founder at PropelloCloud.com | LinkedIn

Mark is the Founder and CEO of Propello Cloud, an innovative SaaS platform for loyalty and customer engagement. With over 20 years of marketing experience, he is passionate about helping brands boost retention and acquisition with scalable loyalty solutions.

Mark is an expert in loyalty and engagement strategy, having worked with major enterprise clients across industries to drive growth through rewards programmes. He leads Propello Cloud's mission to deliver versatile platforms that help organisations attract, engage and retain customers.

.png)