Consistent customer engagement remains a key challenge for many insurance companies – largely because they’ve never had to focus on it before. Traditionally, insurers had little need to engage with customers between policy renewals. And for policyholders, hearing from their insurer usually meant one thing – something had gone wrong.

But times have changed. Modern consumers expect the brands they choose to engage with them. While that expectation hasn’t always extended to insurance, fairly recent regulations on price walking have forced insurers to adapt. Now prohibited from charging loyal customers more at renewal than new ones for the same policy, insurers have had to shift away from acquisition-led strategies and focus more on retention.

In this article, we’ll explore how the insurance sector is responding to these shifting market dynamics. We’ll look at common challenges, proven engagement strategies, and what the future holds for customer engagement in insurance.

|

Written by: |

Contents

-

What Are the Biggest Challenges to Customer Engagement in Insurance?

-

How Can Insurance Companies Improve Customer Engagement in 2025?

-

What Does the Future of Customer Engagement in Insurance Look Like?

Key takeaways

| Customer engagement is widely considered a top priority as a competitive advantage for insurers. | |

|

|

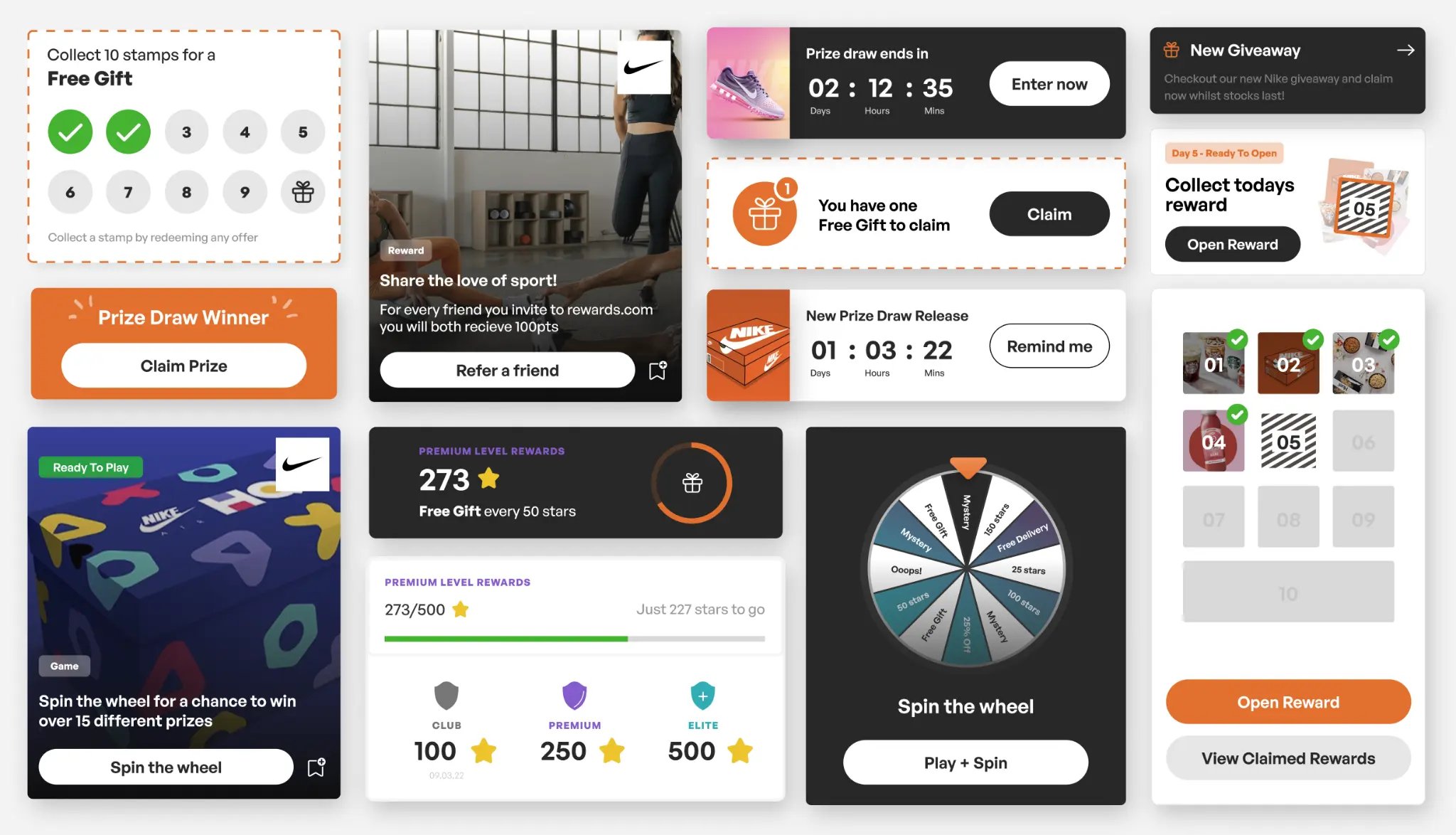

Loyalty and reward programmes drive engagement by increasing meaningful mid-policy touchpoints. |

|

|

Gamification adds interactivity, increasing emotional connection and engagement. |

|

|

Strategic brand partnerships enhance value creation and differentiate insurers. |

|

|

Behaviour-based rewards reinforce positive actions and create meaningful engagement loops. |

|

|

Referral programmes incentivise advocacy and help lower acquisition costs. |

|

|

Personalised customer experience builds rapport, trust, and customer lifetime value. |

|

|

Digital hubs engage customers through community forums, content, and rewards. |

How Are Insurers Approaching Customer Engagement

in 2025?

Faced with changing consumer expectations and limited room to compete pricewise, insurers are rethinking how to build lasting customer relationships. We’ve seen firsthand the shift that’s well underway. In our 2025 Loyalty Uncovered Report, we had conversations with professionals from 100 enterprise level brands. Out of all the insurance companies we spoke to:

-

86% said they were prioritising strategic brand partnerships.

-

83% were pressing on with personalisation.

This signals a clear direction. Insurers are moving on from purely transactional relationships and prioritising customer touchpoints that stimulate ongoing engagement. Strategies like personalised interactions and value-added partnerships are a big part of that. They give customers a reason to stay. Which in turn helps with:

-

Reducing churn

-

Increasing lifetime value

-

Strengthening brand preference

According to Braze’s 2023 Global Customer Engagement Review, brands with effective engagement strategies were 1.8x more likely to exceed their revenue goals.

What Are the Biggest Challenges to Customer Engagement in Insurance?

According to the insurance companies we spoke to, customer engagement stands as their single biggest challenge. Out of all the issues discussed — from API & data integration to data market competition — 85% said they were struggling to meaningfully engage their customers, second only to retail.

Challenges faced by insurers compared to other industries

(Source: Propello 2025 Loyalty Uncovered Report)

Through working with enterprise-level insurance companies like Hagerty UK and Perfect Pet, we’ve identified several underlying factors behind this.

Limited Engagement Opportunities Between RenewalsTraditionally, insurance is a low-touch sector. In the past there was very little interaction between sign-up and renewal. Some customers may have this dynamic embedded in their minds, and as a result, that’s influencing their behaviour. To break the mould insurers will need to be proactive in their communication efforts. |

The Digital Experience Gap in InsuranceLegacy systems are still rife in the insurance sector. This digital debt shows up in the customer experience as a slow, impersonal, and inconsistent service. Friction emerges at every stage of the policyholder journey, the opposite of the seamless, real-time interactions that today’s digital-first customers expect. |

Rebuilding Trust in an Online-First Insurance LandscapeThe age of online interaction has rewritten the rules for earning customer trust. Today’s policyholders want transparency around data use, value exchange, and the absence of hidden catches. Insurers must prove themselves at every digital touchpoint. In this context, credibility and reliability are just as important as convenience and personalisation. |

Connecting With the Digitally Empowered PolicyholderToday’s insurance customers are digitally fluent. They expect the same on-demand experiences they get from leading consumer brands. Engagement strategies must reflect this mindset. Relevance, speed, and convenience are essential across digital channels that customers actually use (mobile apps, social media platforms and real-time messaging).Therefore, consider an omnichannel marketing strategy too. |

Meeting the Needs of a Diverse Customer BaseDemographics vary widely and behaviours and expectations are even more nuanced. Effective engagement means understanding customers on an individual level. Insurers should implement smart customer segmentation, data-driven insight, and tailored outreach, and meet younger, digital-native customers where they are, while still delivering meaningful value to older, more traditional policyholders. |

How Can Insurance Companies Improve Customer Engagement in 2025?

Customer engagement in insurance goes beyond just claims process and renewals. In this section, we explore eight ways insurers are finetuning touchpoints into highly engaging, memorable moments. This includes loyalty programmes and gamification to personalisation, partnerships, and community platforms, designed to drive retention, relevance, and real customer connection.

|

|

|

|

5) Referrals as an Engagement ToolReferral programmes give satisfied policyholders an opportunity to advocate the brand to their friends and family. Naturally, a byproduct of this is improved acquisition. But they also establish a robust engagement loop. Because insurers that reward customers for referring friends or family are encouraging deeper emotional investment in the brand. |

|

|

What Does the Future of Customer Engagement in Insurance Look Like?

The next frontier of customer engagement in insurance will be defined by intelligence, purpose, and participation. As McKinsey notes, the insurers embracing advanced engagement strategies are already seeing:

-

Up to 20% higher customer satisfaction.

-

15% lower churn.

-

40% reductions in service costs.

These benefits are directly linked to the three trends we’re about to explore. These are:

Artificial Intelligence and the Future of Customer ServiceAI is redefining how insurers engage at scale. From a customer’s perspective, most of us will have seen chatbots. Behind the scenes, those involved in the insurance sector may have also seen predictive data analytics at work. These tools enable faster, more relevant support and help us to predict customer needs before they arise. |

Purpose-Driven and Values-Based EngagementToday’s insurance customers still expect protection but they’re also increasingly looking for purpose. |

Feedback, Co-Creation, and Customer-Led InnovationInsurers are increasingly turning customers into co-creators. Both Deloitte’s research and our own experience working with insurance companies point to the same conclusion: co-created solutions tend to drive faster innovation, deeper engagement, and more relevant offerings. |

Make the Customer the Focus and Engagement

will Follow

Customer engagement in insurance should never centre around gimmicks. Keep your engagement strategy customer-centric. Make the way you engage with customers throughout the customer journey relevant, valuable and trustworthy. Loyalty programmes are the perfect solution for bringing various engagement strategies into a cohesive ecosystem – whether you use personalised content, strategic partnerships or build a community.

But technology alone won’t create emotional loyalty. It takes balancing digital transformation with a more human touch, delivering proactive, empathetic experiences that respond to who your customers are and what they value. The future belongs to insurers who embed engagement into their culture. That means thinking beyond the transaction and putting more energy into the quiet middle where most insurers fall silent.

FAQS

Why is customer engagement more important than ever for insurers?

Against the backdrop of changing customer expectations and new regulations, insurers can no longer rely on acquisition alone. Engagement strategies are essential for future retention, loyalty, and differentiation from competitors.

What makes insurance customer engagement uniquely challenging?

Insurance has traditionally been low-touch, with minimal interaction between sign-up and renewal. Breaking that pattern means building new mid-policy value through digital communication and incentives.

How do loyalty programmes improve insurance customer retention?

Loyalty programmes create regular touchpoints between renewals. They reward behaviours like updating details, renewing early, or engaging with content, fostering ongoing interaction and brand loyalty.

What’s the benefit of gamification in insurance engagement?

Gamification introduces interactive elements like challenges, badges, or points, which make engagement enjoyable and habit-forming — proven to increase both retention and brand affinity.

How can portals help insurers engage better with their customers?

Modern insurance portals now offer more than admin — they include content, rewards, and community. Studies show regular portal engagement can improve retention by up to 25%.

Why are brand partnerships valuable in insurance engagement?

They offer everyday value beyond the policy. For example, home insurers partnering with smart device brands create co-branded experiences that resonate with lifestyle needs and drive loyalty.

What role do behaviour-based incentives play in customer engagement?

They reward actions like safe driving or healthy habits. Insurers become part of daily life, and these every day interactions build trust and reinforce positive customer relationships over time.

How can referral programmes strengthen engagement and acquisition?

Referral schemes reward advocacy and encourage deeper brand involvement. Customers that share a brand they trust make acquisition cheaper, faster, and more successful due to higher rapport and trust amongst social circles.

What does personalisation mean in the context of insurance engagement?

Personalisation is all about delivering timely, contextual content and messaging that resonates with an individual’s behaviours and needs. It boosts relevance, and when something is relevant to an individual, they are more likely to resonate and engage with it.

How does community-building benefit insurance brands?

They build a sense of belonging and identity, useful for insurance companies that are typically low-touch. Similarly, if you serve a niche market (like Hagerty does classic car enthusiasts), a community is great because your brand becomes the focal point of customers engaging with each other over shared interests.

Author Bio, Written By:

Mark Camp | CEO & Founder at PropelloCloud.com | LinkedIn

Mark is the Founder and CEO of Propello Cloud, an innovative SaaS platform for loyalty and customer engagement. With over 20 years of marketing experience, he is passionate about helping brands boost retention and acquisition with scalable loyalty solutions.

Mark is an expert in loyalty and engagement strategy, having worked with major enterprise clients across industries to drive growth through rewards programmes. He leads Propello Cloud's mission to deliver versatile platforms that help organisations attract, engage and retain customers.

.png)