Contents:

-

Is now a good time for insurers to nurture customer loyalty?

-

Should insurance providers build a loyalty programme in-house?

-

Best practices for designing and implementing insurance loyalty programmes

Key Takeaways

-

In today's competitive insurance market, a well-designed loyalty programme is crucial for retaining customers and building long-term relationships.

-

Insurance loyalty programmes offer numerous benefits, including improved customer retention, increased engagement, enhanced satisfaction, and higher lifetime value.

-

Successful insurance loyalty programmes should include personalised rewards and incentives, seamless customer experiences across touchpoints, and data-driven insights for customisation.

-

Create targeted rewards and incentives by leveraging customer behaviour. This makes your insurance loyalty programme more effective at driving deeper engagement, satisfaction and customer relationships.

-

When deciding whether to build a loyalty programme in-house or partner with a third-party provider, insurance companies must consider factors such as expertise, time to market, cost, flexibility, and risk.

-

Best practices for designing and implementing insurance loyalty programmes include identifying the target audience, defining goals, determining rewards, designing the programme structure, creating a marketing plan, implementing tracking and analytics, and monitoring and adjusting the programme as needed.

Is Now a Good Time for Insurers to Nurture Customer Loyalty?

In my experience, now is an ideal time for insurance providers to consider implementing a loyalty programme. In fact, I’m willing to go far as to say that in today's competitive insurance market, a well-designed loyalty solution is a total game-changer.

Insurance companies can differentiate themselves and build strong, lasting relationships with customers, just by offering personalised services, premium discounts, and valuable rewards. I've seen firsthand how the right loyalty programme can transform an insurance business, leading to higher satisfaction, reduced churn, and increased customer lifetime value.

While the decision ultimately lies with each provider, exploring the potential benefits of an insurance loyalty programme now will help you understand why those businesses that implement them stay ahead of the curve.

The Benefits of Implementing Insurance Loyalty Programmes

The power of well-designed insurance loyalty programmes lies in the multitude of benefits that they offer. Each of which contributes significantly to all businesses. I know firsthand the impact a loyalty programme has on an insurance company and its long-term success. But here’s just a few stats you can see for yourself online:

1. Improved customer retention and reduced churn

One of the most notable advantages is improved customer retention and reduced churn. By giving customers a compelling reason to stay, such as valuable rewards and personalised experiences, loyalty programmes can effectively decrease churn and increase customer lifetime value:

In fact, a whopping 84% of customers say they are more likely to remain loyal to brands that offer loyalty programmes.

2. Increased customer engagement

But the benefits don't stop there. Insurance loyalty programmes also have the potential to greatly enhance customer engagement. By encouraging regular interaction and offering value at critical touchpoints, providers can pave the way for cross-selling and up-selling opportunities:

Customers engaged with a loyalty programme spend 12-18% more than non-loyalty programme members.

3. Increased customer satisfaction

It's clear that loyalty programmes play a vital role in keeping customers happy and engaged. That’s why when customers receive great rewards and feel valued and appreciated, their satisfaction levels soar:

58.7% of internet users consider earning rewards a key aspect of a great and satisfying customer experience.

4. Point of difference

In today's crowded insurance market, a well-designed loyalty programme is a powerful differentiator. By offering unique rewards and personalised experiences, insurance providers can stand out from the competition and build a loyal customer base:

A remarkable 72% of consumers claim that loyalty programmes are integral to their relationships with brands.

5. Enhanced brand loyalty and advocacy

But perhaps one of the most valuable aspects of a great loyalty programme is the data and insights it provides into customer behaviours and needs. Leveraging this information leads insurance companies to better understand their customers, tailoring their offerings accordingly, resulting in better experiences and loyalty:

In fact, 75% of consumers say they are more likely to be loyal to brands that know and understand them as individuals.

6. Higher customer lifetime value

Ultimately, all of these benefits combine to create a healthier bottom line for insurance providers. Demonstrating the tangible impact these programmes can have on revenue growth:

A survey found that 64% of loyalty programme members increase their spending to earn more points. However, we’ve found that insurance loyalty programmes rarely use points-based systems (just something to consider).

Key Elements of Successful Insurance Loyalty Programmes

Designing a successful insurance loyalty programme requires a deep understanding of your customers' needs, preferences, and behaviours. While there are various types of loyalty programmes, such as always-on, referral, gamified, and partner programmes, the key to success lies in creating a programme that resonates with your specific target audience.

In my experience, the most effective insurance loyalty programmes share several critical elements that work together to achieve specific business goals. Mainly around always-on programmes that offer instant access to relevant rewards from partner brands.

Personalised rewards and incentives

Personalised rewards and incentives that align with your customers' individual needs and preferences is one of the most crucial aspects of a successful insurance loyalty programme

In addition to insurance-related perks and premium discounts, consider offering lifestyle rewards that resonate with your customers' values and interests, such as health and wellness perks.

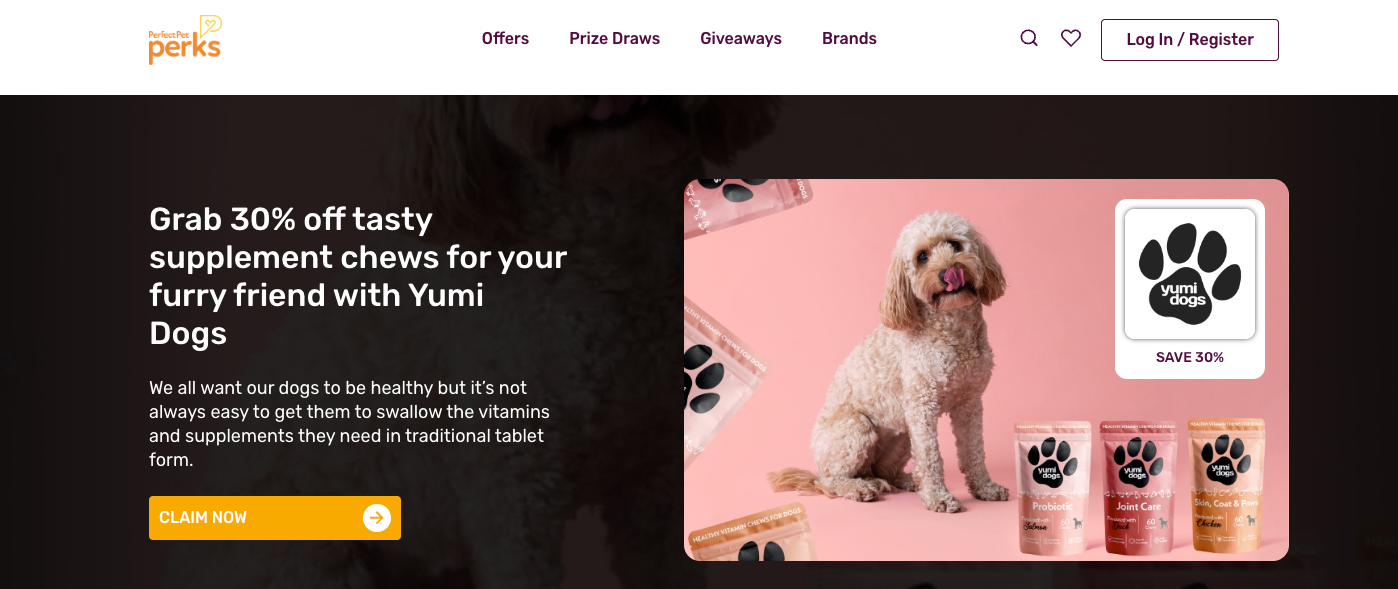

Pet Insurer, Perfect Pet, offers customers rewards and discounts on related products such as healthy pet food supplements.

Seamless customer experiences across touchpoints

Strong and lasting relationships with customers call for seamless and consistent experiences across all touchpoints. This means integrating your loyalty programme with your digital platforms, such as:

-

Your website.

-

Mobile app.

-

Social media channels.

This ensures that your customers can easily access and engage with your programme wherever and whenever they choose. Moreover, include regular updates on loyalty programme benefits, personalised offers based on customer behaviour, and timely reminders to redeem rewards. Maintaining consistent communication creates a cohesive and frictionless experience.

Data-driven insights and customisation

As I mentioned a bit earlier, leveraging customer data is an extremely effective way to gather valuable insights about your customers' needs, preferences, and behaviours. Analysing data from your loyalty programme, as well as other sources such as customer feedback and market trends, reveals patterns and opportunities to optimise your programme and drive better results.

For example, you can use predictive analytics to identify customers who are at risk of churning and proactively engage them with targeted retention strategies, such as personalised offers and reward incentives.

Additionally, by segmenting your customers based on their behaviour and preferences, you can create more targeted and effective marketing campaigns that drive engagement and loyalty.

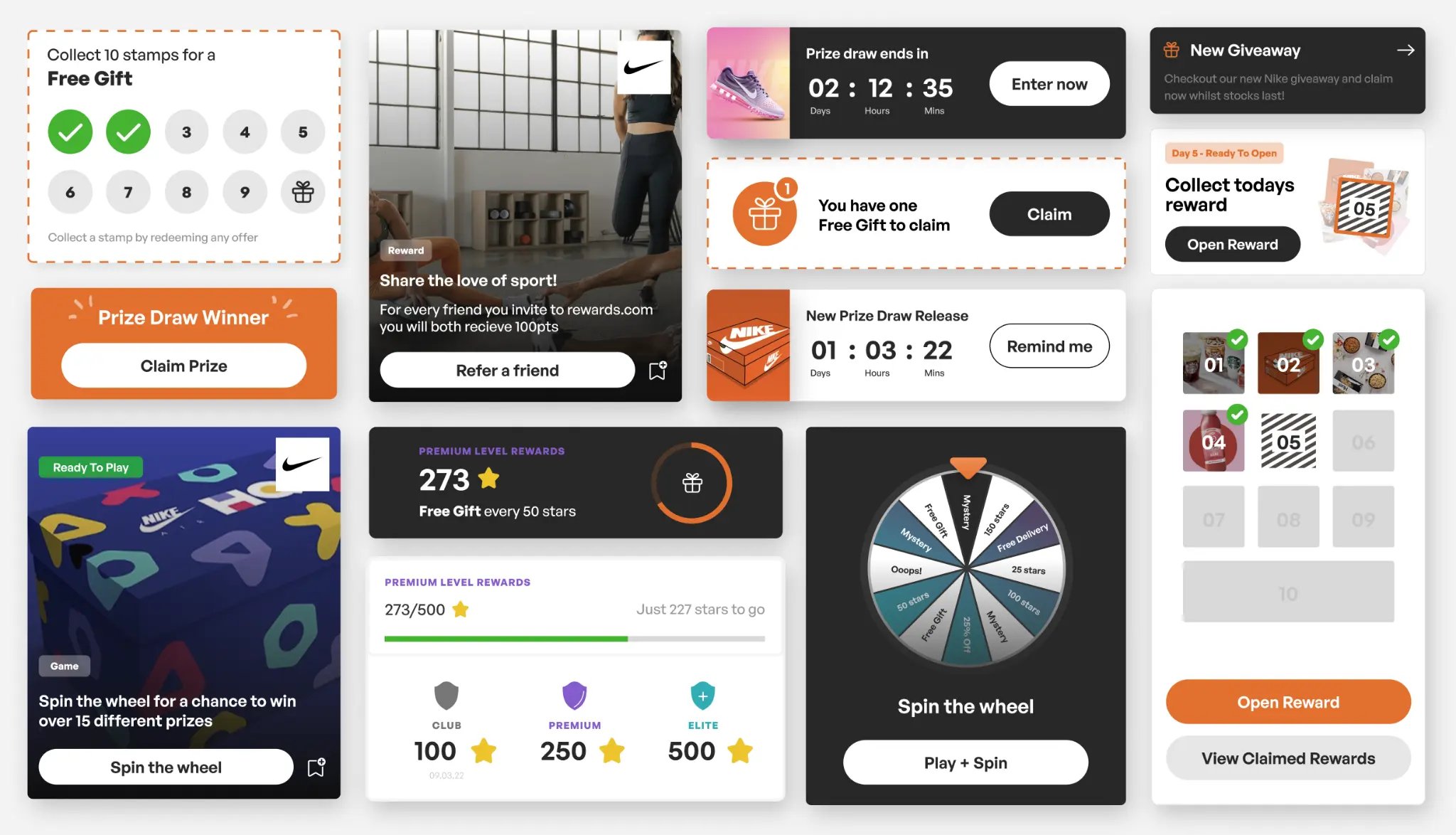

Gamification elements

Adding gamification elements into your insurance loyalty programme greatly improves the chance of boosting customer engagement and motivation to participate. Game-like features, such as challenges, badges, and leaderboards, tap into customers' competitive nature and desire for achievement.

For example, you could create a challenge where customers earn points for completing specific actions, like referring friends or participating in wellness activities. As they accumulate points, customers unlock new levels or tiers, each offering increasingly valuable rewards. This not only encourages desired behaviours but also makes the experience of interacting with your brand enjoyable for customers.

Conditional rewards

Offering conditional rewards and incentives is another powerful way to drive specific customer behaviours and enhance the effectiveness of your insurance loyalty programme. Setting clear conditions for earning rewards, motivates customers to take desired actions, such as a policy renewal.

Conditional rewards can also be tied to specific products or services, such as offering bonus benefits for purchasing multiple policies or bundling insurance products. By incorporating conditional rewards and incentives into your loyalty programme, you create a more dynamic and personalised experience that adapts to individual customer preferences and behaviours.

This level of customisation not only drives engagement but also demonstrates your commitment to understanding and meeting your customers' unique needs. Ultimately leading to higher value customers.

Should Insurance Providers Build a Loyalty Programme In-house?

While there's no one-size-fits-all answer, there are several key factors that you should carefully consider when answering the build v buy question.

1. Expertise

Building a successful loyalty programme requires a deep understanding of loyalty programme design, implementation, and management. Insurance providers must objectively assess whether they have the necessary skills and resources in-house to effectively create and manage a programme that drives long-term customer engagement and retention.

Having a dedicated team with expertise in areas such as customer success, loyalty software development, and marketing is essential for nurturing loyalty and maximising the impact of your programme.

2. Time to market

Building a programme from scratch can be a lengthy process, always requiring significant investments in technology, personnel, and other resources. Insurance providers should weigh the benefits of having complete control over the programme against the potential delays and opportunity costs associated with an in-house approach.

Partnering with a third-party provider often helps accelerate time to market, allowing insurers to start realising the benefits of their loyalty programme sooner.

3. Cost

Cost is another critical consideration when deciding between an in-house or outsourced loyalty programme. Building a programme from the ground up can be expensive, with significant upfront and ongoing management costs. Carefully evaluate the total cost of ownership for an in-house programme compared to the costs of partnering with a third-party provider.

In many cases, outsourcing can provide a more cost-effective solution, particularly for smaller insurers or those with limited resources.

4. Flexibility

An in-house loyalty programme may offer more control over programme design and management, but consider the level of flexibility and customisation offered by third-party providers. Some providers offer highly configurable platforms that can be tailored to meet the specific needs and goals of individual insurers. At Propello, for example, my team and I strive to keep our platform flexible.

So, when evaluating potential partners, look for providers that offer a balance of flexibility and proven best practices. That way, your programme is not limited when your needs change over time.

5. Risk

Finally, insurance providers must carefully assess the risks associated with building a loyalty programme in-house. Designing and launching a programme can be complex, and there's always the possibility of encountering unexpected challenges or delays. That’s why it’s always a good idea to consider risk tolerance.

In some cases, partnering with an experienced third-party provider can help mitigate risks and ensure a smoother, more successful programme launch and ongoing management.

Best Practices for Designing and Implementing Insurance Loyalty Programmes

Here are some best practices for designing and implementing insurance loyalty programmes:

1. Identify the target audience

Before diving into the details, it's crucial to determine who your loyalty programme will serve. Are you looking to reward long-time customers or those who have purchased multiple policies? Clearly defining your target audience will guide your programme's design and ensure its effectiveness.

2. Define the programme goals

Once you've identified your target audience, set clear, SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals for your loyalty programme. Whether you're focusing on customer retention or driving sales growth, having well-defined objectives will help you measure success.

3. Determine the rewards

Choose rewards that align with your customers' preferences and encourage desired behaviours. From cashback and discounts to free coverage, there's a wide range of options. Don't be afraid to mix and match rewards to keep your programme engaging and effective.

4. Design the programme structure

Select the loyalty programme type that best suits your audience, goals, and rewards. As discussed earlier, options include Always On, premium, referral, gamified, and partner programmes. Your choices in the previous steps will guide you towards your most appropriate structure.

5. Create a marketing plan

Develop a comprehensive marketing plan to promote your loyalty programme to customers. This should include email campaigns, social media ads, and other channels that effectively reach your target audience. A well-executed marketing plan is essential for driving programme adoption and engagement.

6. Implement tracking and analytics

Establish a data collection method before launching your loyalty programme to monitor its performance and gather valuable insights. Continuously track customer engagement and use this data to refine and optimise your programme over time.

7. Monitor and adjust the programme

Allocate sufficient management resources to monitor your loyalty programme from day one. Be prepared to make adjustments as needed to ensure the programme consistently meets your goals and your customers' needs. Regular monitoring is key to maintaining a successful loyalty programme.

Insurance Loyalty Programme Examples

By designing successful loyalty programmes for insurance providers, our team at Propello has gained a deep understanding of the unique challenges and opportunities within various sub-sectors. We've developed tailored solutions that strengthen customer relationships and drive significant business results. So, when I come across a new example of an insurance loyalty programme, I'm always eager to analyse the reasoning behind their design decisions.

Let's explore some interesting examples together and uncover the strategies that make them effective in cultivating customer loyalty and achieving sustainable growth.

Motor Insurance

In the auto insurance sector, customer loyalty has been on a decline, with the percentage of policyholders who say they will definitely renew their policy with their current insurer dropping from 59% in 2004 to just 48% in 2019. And whilst consumer premiums saw a temporary dip in early 2022, predictions for 2023 suggest that rates may surge by as much as 18% due to inflation.

Significant price fluctuations are a powerful driver for consumers to shop around and explore alternative options. In such competitive landscapes, offering valuable and relevant rewards through a well-designed insurance loyalty programme demonstrates to customers that you value their business and are committed to their satisfaction.

By promoting these customer-centric values in your brand image, particularly in an industry often associated with negative consumer sentiments, you can effectively differentiate yourself from competitors and secure long-term customer loyalty.

Allstate

-

Allstate's telematics programmes, Milewise and Drivewise, track and analyse motorist habits.

-

Safe driving behaviours are rewarded with points redeemable for discounts on various items and experiences.

-

This approach encourages safe driving practices while offering tangible benefits.

-

The accident forgiveness benefit is designed to retain customers with a history of safe driving.

-

By assuring customers that their premiums won't increase due to an isolated accident, Allstate demonstrates its commitment to long-term relationships and understanding of individual circumstances.

Home Insurance

In the home insurance sector, the increasing availability of smart home products like water shut-off valves, connected leak detectors, motion sensors, smoke alarms, and smart locks is giving homeowners access to powerful new safety systems.

Installing even a single smart device—whether for safety, health, or convenience— significantly lowers the risk profile of policyholders. This presents a valuable opportunity for insurers to reward customers who embrace these safety-conscious behaviours with extra value that strengthens brand loyalty.

Carriers that provide tailored service options for policyholders who choose to share their smart home data also see significant improvements in customer loyalty. According to Baines and Company, more than 80% of customers are open to an ecosystem of services, with many even preferring to have these services provided by their insurer.

John Lewis

-

John Lewis's Home Assurance package includes home insurance, 24/7 emergency response, smart devices, a dedicated app, and gas and electric inspections.

-

This comprehensive solution addresses various aspects of home safety and convenience.

-

John Lewis differentiates itself from competitors and provides customers with a compelling reason to remain loyal.

-

Offering discounts on homeowner's policies based on criteria like age, safety and security features, and length of insurance history is a strategic move.

-

This rewards and retains low-risk, long-term customers by acknowledging and incentivising customer loyalty and risk-mitigating behaviours.

Health Insurance

Unlike other insurance sectors, health insurance is not something that people actively seek out, which makes it much harder for health insurance companies to win over customers.

In fact, a survey by Accenture found that 26% of people with health insurance felt no loyalty toward their insurer, which comes as no surprise given the steady increase in the health insurance CPI (Consumer Price Index) over the past decade.

The rising CPI, which reached a high point of 121 in 2019, reflects a consistent increase in the cost of medical coverage. From 2008 to 2019, the cost of health insurance rose by an average of 6% annually, putting pressure on health insurance companies to work hard to prove their worth to customers.

Oscar

-

Oscar's approach to rewarding members focuses on improving health outcomes.

-

This increases customer satisfaction and loyalty while reducing the insurer's monthly healthcare costs.

-

Oscar offers access to a concierge team of doctors and medical experts through their digital platform.

-

An app-based health insurance advice team is also available to members.

-

Oscar demonstrates its commitment to preventive care and personalised support, setting itself apart from traditional health insurance providers.

Vitality

Customers earn points in the loyalty programme by connecting their activity trackers to Vitality. In general, the more points you earn, the better the rewards you'll receive. There could be discounts on Apple Watches and Fitbits, as well as on hotel stays booked through Expedia.

Insurers can take baby steps like these by having their procurement and legal departments form informal alliances with businesses that offer complementary services, such as fitness centres. This would help them deliver value more quickly and make redemption less cumbersome.

With its reward programme, Vitality is actively lowering the risk associated with each policyholder, while providing excellent value to customers and helping to retain them for the long haul.

Vitality's model is a great example to follow. By providing customers with a compelling incentive to maintain their brand loyalty and collecting information (via fitness devices) that will be used to tailor their experience, Vitality attracts and retains a steady stream of repeat business.

Travel Insurance

Higher inflation directly influences booking rates and spending behaviours of tourists, which is why loyalty programmes are such a crucial weapon in the battle to keep customers in the travel industry. When faced with rising costs and economic uncertainty, travellers become more discerning in their choices and actively seek out ways to maximise their value for money.

Providing a range of enticing perks, such as premium discounts, exclusive amenities, and personalised experiences, create a strong emotional connection with customers. This emotional bond is essential for long-term loyalty, as it goes beyond mere transactional benefits and taps into the customer's desire for recognition, appreciation, and value alignment.

Moreover, partnering with carefully selected brands and venues that resonate with their target audience, travel insurance companies can create a loyalty ecosystem that not only incentivises repeat business but also attracts new customers through word-of-mouth and social proof.

Staysure

-

Staysure's referral marketing campaign was implemented in response to the positive feedback and loyalty from customers.

-

The campaign enables dedicated customers to invite friends and family, tapping into the power of social proof and word-of-mouth marketing.

-

This creates a self-reinforcing, cost-effective cycle of loyalty and growth.

-

Focusing on social media sharing as a key component of their referral programme aligns with the growing trend of consumers making travel plans based on content shared by friends and family on social platforms.

-

By leveraging this trend, Staysure encourages customer engagement and expands its reach to new potential customers who are more likely to trust recommendations from their personal networks.

Embracing the Power of Insurance Loyalty Programmes

Implementing a well-designed insurance loyalty programme is a powerful way to retain customers, increase engagement, and drive long-term growth in today's competitive market. By understanding your target audience, setting clear goals, and leveraging data-driven insights, you can create a programme that resonates with your customers and sets your brand apart.

As you embark on your loyalty programme journey, remember that success is an ongoing process that requires continuous monitoring, optimisation, and adaptation to changing customer needs and market conditions.

Embracing the power of insurance loyalty starts with learning how to build loyalty programmes. Check out our free "Insurer's Guide to Building Customer Loyalty Programmes". See firsthand step-by-step instructions that will get your loyalty programmes off to a winning start.

FAQs

What is an insurance loyalty programme?

An insurance loyalty programme is a rewards system designed to incentivise customers to stay with their current insurance provider by offering personalised rewards, discounts, and experiences based on their loyalty and engagement with the brand.

How can an insurance loyalty programme benefit my company?

Offering personalised rewards and experiences, differentiates your brand and builds stronger, lasting relationships with customers in the highly competitive insurance market.

What are the key elements of a successful insurance loyalty programme?

The key elements of a successful insurance loyalty programme include personalised rewards and incentives that align with customers' needs and preferences, a seamless customer experience across all touchpoints, and data-driven insights for customisation.

Should I build an insurance loyalty programme in-house or partner with a third-party provider?

The decision to build an insurance loyalty programme in-house or partner is ultimately up to you! Just carefully consider several factors, including your company's expertise, desired time to market, available budget, need for flexibility, and risk tolerance.

What are some best practices for designing and implementing an insurance loyalty programme?

Best practices for designing and implementing an insurance loyalty programme include clearly defining your target audience and programme goals, selecting appropriate rewards, designing a programme structure that aligns with your objectives, implementing tracking and analytics, and continuously monitoring the programme.

How can I measure the success of my insurance loyalty programme?

Measuring the success of your insurance loyalty programme involves tracking key performance indicators (KPIs) such as customer retention rates, engagement levels, customer satisfaction scores, and customer lifetime value.

How can I ensure my insurance loyalty programme offers a seamless customer experience?

To ensure a seamless customer experience, integrate your loyalty programme with your digital platforms, such as your website, mobile app, and social media channels. Maintain consistent communication with customers, providing regular updates on programme benefits, personalised offers, and reminders to redeem rewards.

What types of rewards should I offer in my insurance loyalty programme?

The types of rewards you offer in your insurance loyalty programme should align with your customers' preferences and encourage desired behaviours. Consider offering a mix of rewards, such as premium discounts and personalised experiences.

How can I use data to personalise my insurance loyalty programme?

Leverage customer data from your loyalty programme and other sources, such as customer feedback and market trends, to gain valuable insights into your customers' needs, preferences, and behaviours. Use this data to segment customers based on their preferences.

What are some examples of successful insurance loyalty programmes?

Some examples of successful insurance loyalty programmes include Allstate's Drivewise and Milewise programmes, which reward safe driving habits; and Staysure's referral marketing campaign, which leverages social proof and word-of-mouth marketing to drive loyalty and growth.

Author Bio, Written By:

Mark Camp | CEO & Founder at PropelloCloud.com | LinkedIn

Mark is the Founder and CEO of Propello Cloud, an innovative SaaS platform for loyalty and customer engagement. With over 20 years of marketing experience, he is passionate about helping brands boost retention and acquisition with scalable loyalty solutions.

Mark is an expert in loyalty and engagement strategy, having worked with major enterprise clients across industries to drive growth through rewards programmes. He leads Propello Cloud's mission to deliver versatile platforms that help organisations attract, engage and retain customers.

.png)

.png)