In this blog, we’ll be exploring the top 2026 membership trends identified in our latest research.

Sustained growth for any organisation takes a great deal of determination and adaptability. Keeping your finger on the pulse of the latest trends allows you to prepare and adapt to changing environments. You'll know what to prioritise when meeting member expectations.

|

Written by: |

Contents:

-

What are the Top 15 Membership Trends to Watch Out For?

-

How Will Membership Engagement Redefine the Member Experience?

-

Why is New Member Acquisition Now a High Priority?

-

Why is Hyper-Personalisation Essential for Member Retention?

-

Why Are Tech Integration and Digitisation Critical to Membership Growth?

-

How Will Gamification Turn Passive Members into Habitual Participants?

-

How Can Partnerships Be Leveraged Across the Membership Lifecycle?

-

Key Takeaways

|

Engagement, acquisition, retention top the agenda. Engagement is the #1 priority with 86% of organisations ranking it as a high priority, followed by acquisition 82% and retention 78%. |

|

|

|

Big execution gap on engagement. Despite its importance, only 41% of large organisations (and 27% overall) have a documented engagement strategy which results in fragmented member experiences and churn. |

|

|

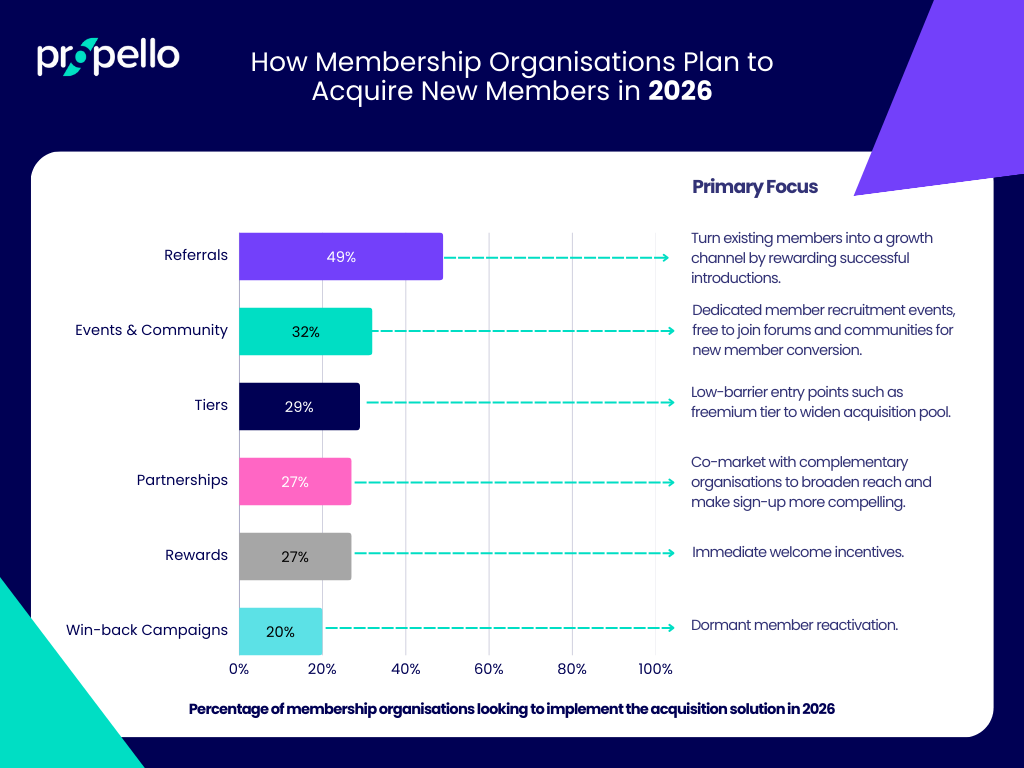

Acquisition is shifting to low-cost, trust-based channels. 49% plan to consider or review referral programmes, 32% will deliver more recruitment events, 29% will consider or introduce low-barrier entry/freemium tiers, 27% will increase partner marketing for amplified reach, 27% are considering the introduction of welcome incentives. |

|

|

Tiers and behaviour-linked rewards to drive retention 69% see tiers as an important retention strategy as it helps cement buy-in; 46% are interested in conditional rewards to incentivise membership renewals, 41% will increase partnerships activity to aid retention, 33% see events as key to retention and 28% will focus on better initial onboarding to communicate value early on to help secure long-term renewals and Lifetime Value (LTV). |

|

|

Member value must be visible and “pay for itself. 72% overall rank it as a high priority. If members can see savings and progress all year (not just at renewal), they stay. Teams are making value visible with perks that offset fees, stronger partnerships, smarter onboarding, and tiered bundles. |

|

|

Revenue diversification is accelerating. Of those increasing activity to broaden income beyond dues, 73% will monetise partners/affiliates, 52% are looking to launch premium tiers, 48% are looking to cross-sell/upsell and 39% plan to leverage additional revenue from events. |

|

Propello is proud to be a MemberWise Recognised Supplier, trusted by leading membership organisations including NASUWT, The Ivors Academy, ISM, and the Royal College of Surgeons of Edinburgh. |

What are the Top 15 Membership Trends to

Watch Out For?

What does the future hold for membership organisations? To answer that, we must look to the top priorities of membership organisations on a sector-wide basis. During our research, we asked enterprise membership organisations organisations what their most pressing challenges were. From this we identified seven key focus points - the first seven trends (1-7) in this article.

| Priority | Critical* | High Priority | Rank |

|

Member Engagement |

26% |

86% |

1 |

|

Member Acquisition |

24% |

82% |

2 |

|

Member Retention |

- |

78% |

3 |

|

Member Value |

12% |

72% |

4 |

|

Revenue Diversification** |

10% |

66% |

5 |

|

Tech Integration |

- |

64% |

6 |

|

Personalised Member Experience |

- |

58% |

7 |

* The primary focus for the organisation (organisations can have several high priorities)

** Revenue Diversification includes revenue beyond membership fees, e.g cross-selling and upselling, partnership and affiliate monetisation and premium tiers.

Source: Propello Research (September 2025)

Trending Focus Areas & Challenges

Based on our research, we've listed the key challenges and what solutions organisations are planning to implement next year to help solve them.

1) How Will Membership Engagement Redefine the Member Experience?

A membership engagement strategy completely overhauls standard transactional relationships into personalised, value-driven journeys. We know it's a success when members feel recognised and connected as a result of tailored communication and relevant benefits at every touchpoint. All this culminates into deeper emotional loyalty and adds value to every touchpoint within the member lifecycle.

What are the causes of poor member engagement?

Poor membership engagement is often the result of a combined misalignment in benefits, outdated technology, lacklustre support, and service standards failing to meet member expectations. Unclear value also plays a major role, especially with generic, irrelevant rewards that make membership journeys feel disjointed and uninspired. This often leads to:

-

Irrelevant or outdated benefits that don’t meet member needs

-

Frustrating and disappointing experiences as a result of fragmented technology and data

-

Complicated onboarding, reward redemptions, and membership renewals

-

Poor customer service and slow issue resolution

-

Uninspired value propositions that fail to maintain interest at key touchpoints

Our insights...

As the top priority for most membership organisations that we spoke to, we expect to see member engagement strategies continue to be a main focus going into 2026.

26% of large membership organisations see member engagement as their biggest focus. 86% of the sector overall rank it as a high priority.

Propello Cloud Membership Organisation Report

Yet...

Only 41% of large membership organisations (£3m+) and 27% of the sector overall have an engagement strategy.

MemberWise Digital Excellence Report

Between our research and MemberWise's findings we're able to see the current state of the industry in respect to member engagement. It's a top focus precisely because many organisations still lack documented plans. Without clear goals, fragmented experiences become the status quo, and membership growth stagnates as a result. The problems don't end there. Disengaged members churn at the time of renewal, forcing organisations to spend more on acquisition to replace them.

How are membership organisations engaging their members?

To close the gap, membership organisations said they are looking to clarify value exchange, improve datasets, and promote a sense of community at key touchpoints to lift satisfaction and by extension, renewal rates.

But how does that look?

-

65% plan to test gamification. People enjoy interactive elements. In addition, gamification encourages habit-building.

-

63% expect to review their tiered membership structure. Not only do tiers lay down clearer paths towards higher status benefits, they actively compel organisations to improve datasets for more accurate segments.

-

58% are looking at rewards to motivate specific behaviours. This presents opportunities for promoting participation in the community.

-

44% will strengthen partnerships. Co-branded content, resources and campaigns have a much better chance to align with a variety of member interests.

-

44% want better use of data. Again, accurate data allows for refined segments, aligning experiences, rewards, and wider value propositions to member preferences.

-

30% are targeting events and community initiatives. What's better at driving participation in an organisation's community, than events and initiatives that lead to member interaction and collaboration?

-

26% plan on improving onboarding. This sets the tone for newcomers, giving membership organisations a fast win opportunity, with highly engaging and exciting welcomes.

Interactive digital platforms and rewards programmes tie all the above together into a comprehensive engagement strategy that's relevant to your members' needs.

Source: Propello Research (September 2025)

2) Why is New Member Acquisition Now a High Priority?

Member acquisition ranks the second-highest priority due to natural attrition constantly eating away at membership bases. Rising operational costs hinder growth, which also adds pressure on revenues generated by membership fees. Organisations need fresh members to achieve growth targets, diversify their demographics, and maintain long-term sustainability.

What are the causes of poor member acquisition?

Poor acquisition performance occurs when organisations fail in several key areas. Usually, it comes down to a combination of not clearly articulating value, of not targeting prospects with the right offer or friction during the joining process. If joining feels complicated, high-risk or irrelevant, prospects will hesitate and most likely walk away. To summarise the main causes of poor acquisition:

-

Unclear or generic value propositions that don't answer “why join now?”

-

Overly complex sign-up journeys with too many steps or barriers to entry

-

Weak targeting or reliance on broad, generic campaigns

-

Limited proof of value: few testimonials, success stories or tangible outcomes

-

Overemphasis on short-term discounts instead of demonstrating long-term benefits

Our insights...

Whilst large membership organisations are certainly focusing on acquisition, it's often done so alongside engagement and retention. This indicates membership organisations are adopting a mature and balanced approach, rather than panicked growth-at-all-costs strategies. With this in mind, we expect to see emphasis on acquisition continue, as organisations look to offset churn, and drive sustainable growth that sees them through 2026 and beyond.

Our research found that 82% of membership organisations rank acquisition as a high priority, with 24% citing it as their biggest priority.

Strong member acquisition strategies lead to other benefits too, including:

-

Supporting growth targets when retention levels plateau

-

Diversifying the member base by attracting younger demographics

-

Increasing referrals (boosting organic growth and reducing CAC in the process)

-

Improving the acquisition pipeline; reducing an over-reliance on lower membership fees or discount-driven retention

How are membership organisations attracting new members?

Our research reveals a clear shift towards reducing acquisition costs, broadening reach, and quickly communicating value to new members.

-

49% plan to introduce referral programmes. Advocacy is one of the most cost-effective acquisition strategies. Marketing campaigns are expensive and not always successful. Referrals on the other hand, tap into the trust existing between your members and people in their personal networks. More often than not, that's more than enough for people to sign-up.

-

32% expect to use recruitment events and community forums. Peer validation reinforces positive behaviours. When prospects interact with your existing members, that personal conversation goes a long way in building trust and reassurance.

-

29% are exploring low-barrier entry points. Freemium tiers widen the acquisition pool due to levelling the playing field for potential members with limited funds or resources.

-

27% will co-market with complementary organisations. Partnering with another brand broadens your reach because it puts you in front of their audiences. Plus, member access to exclusive offers from your partners improves overall member value propositions (MVPs).

-

27% will introduce immediate welcome incentives. Similar to some engagement strategies, this instantly sets a positive tone. Welcome gifts or other incentive types can be that extra hook to successfully pull in new members.

-

20% plan to run win-back campaigns. This underused tactic is a great way of reactivating dormant or lapsed members.

Together, these strategies show the potential of fully optimised acquisition cycles. With the right solution, membership can bring each of these into a cohesive system, using various touchpoints in the acquisition phase that provide instant delight and drive referrals.

Source: Propello Research (September 2025)

3) Why is Member Retention Still Key to Sustainable Growth?

Member retention remains critical alongside engagement and acquisition. Retaining existing members is considerably more cost-effective than acquiring new ones. Plus, successful retention tends to lead to renewals, which provide a recurring revenue base for organisations that need stability. Strong retention also improves the value of acquisition. Organisations with high retention after all, enjoy higher member lifetime value. So each new member brought on board has the potential to generate value during longer tenures. In a climate of rising acquisition costs, that's huge.

What are the causes of poor member retention?

Retention challenges often arise when organisations don't deliver sustained value beyond the initial sign-up. If members don’t feel a strong connection, see ongoing benefits, or achieve progress toward their goals, they are more likely to lapse at renewal. To summarise:

-

Value feels static when benefits don’t evolve with changing needs

-

Few signals of progress (no milestones, recognition, or “you’re getting more from this” moments) harm retention

-

One-way communications that just broadcast updates instead of nurturing relationships

-

Disjointed journeys across web, app, events and support, make value hard to find

-

Limited peer connection, mentorship or contribution pathways also limit retention rates

-

Data blind spots prevent early intervention with at-risk members

-

Costs may be clear but ongoing outcomes aren’t, resulting in value mismatch

Our insights…

Organisations that maintain a focus on retention are better positioned to protect revenue, grow lifetime value and create unique communities that members won't want to leave.

Retention remains one of the defining challenges for membership organisations. While acquisition brings in new members, keeping them delivers the greatest return on investment. Yet, although our research revealed that many organisations regard retention as a high priority, only a fraction have structured strategies in place. This includes methods of measuring churn risk, early interventions to prevent churn, and effective ways of sustaining value at every stage of the journey. Without these, churn erodes growth, forcing costly cycles of replacement on organisations.

78% of membership organisations rank retention as a high priority. 20% name it as their single biggest priority.

Organisations that take proactive steps towards retention (such as predicting risk and proving value all year round) will improve revenue and lifetime value.

How are membership organisations retaining members?

There's a shift towards proactive retention, which involves the adoption of the strategies we touched on above.

-

69% are considering member tiers. Tiered structures better fit evolving needs, increasing stickiness and organisational buy-in.

-

46% are exploring conditional rewards. These help promote desired behaviours e.g., renewals. Plus, they provide everyday savings which offset the cost of membership.

-

41% are strengthening partnerships. These are usually centred around accredited learning, CPD and mentorships that drive professional and personal value.

-

33% will focus on events and community initiatives. A great way of building a sense of belonging and professional and personal relationships between members that are difficult to leave.

-

28% plan to enhance onboarding. New members quickly understand, connect with and gain value from their membership early on, when the organisation offers an unforgettable welcome.

Together, these approaches also highlight a continued focus on the member experience, delivering ongoing value, building connections and leveraging recognition throughout member journeys.

Source: Propello Research (September 2025)

4) How Can Membership Organisations Enhance Member Value?

Acquisition typically grabs all the headlines, but improving value propositions remains an integral but often overlooked strategy. Demonstrating what members will receive in benefits and how your mission aligns with their interests will aid your acquisition efforts. Indeed, effectively conveying the value your organisation has to offer, also has positive implications for membership engagement and retention.

See how Hagerty delivers member value for its Drivers Club members

What are the causes of poor member value delivery?

A lack of perceived value often stems from misaligned benefits and weak communication. If members can’t clearly see how the fee translates, professional development or belonging, they’re quick to disengage. Value is also undermined by outdated benefits, poor onboarding, or fragmented technology that hides the true ROI of membership.

-

Outdated member value propositions that don't resonate with changing member demographics, needs or requirements

-

Benefits that feel irrelevant or outdated

-

Limited or unclear onboarding journeys

-

Overemphasis on discounts without career/mission value > price/value mismatch

-

Fragmented systems that prevent joined-up experiences

The foundations for delivering member value successfully stem from your MVP. Read more in our article:

How to Craft a Compelling Member Value Proposition for Retention.

Our insights...

Member value is no longer up for choice. Where once it was seen as a point of differentiation, delivering extra value is now a baseline necessity. To even compete require extra member value. Yet delivering value remains a defining challenges in the membership sector. Our research shows that:

12% of membership organisations view delivering member value as their biggest priority. 72% overall rank it as a high priority.

From our conversations, many lack the tools to quantify or showcase value at renewal.

How are membership organisations enhancing member value in 2026?

The strongest results come when teams quantify usage and savings, surface outcomes (career wins, CPD progress), and keep everyday value visible. Often these are available via closed-user-group perks, which contribute to fees “paying for themselves.” When this is consistently done, renewal rates improve and churn falls.

-

44% aim to offset the cost of membership.

-

36% will create greater value through actionable insights. Peer-to-peer networking, discussions, and interactions at events and communities provide ample opportunity to understand what matters to members.

-

31% aim to improve onboarding.

-

33% plan to extend their value stack through partnerships.

-

33% will package benefits into tiered bundles.

We don't need to explain the outcomes in detail, but one thing this tells us, the strategies in play are pretty consistent across the board. Membership organisations clearly understand the draw of rewards that help members offset the cost of membership fees through tangible savings and perks. Similarly, improved onboarding has been recognised almost as a panacea for several of the most pressing challenges. The same can be said for both partnerships and tier structures.

Source: Propello Research (September 2025)

.png?width=1024&height=768&name=Membership%20Value%20Stats%20Report%202026%20(1).png)

5) How Can Membership Organisations

Diversify Revenue?

Revenue diversification reduces risk and creates headroom for growth. Relying mainly on dues leaves organisations exposed to volatile renewal swings and unforeseen macro events. A broader spread of revenue insulates organisations from these threats. Partners, premium tiers, paid add-ons, and events help to generate revenue streams across multiple touchpoints. When done well, diversification turns engagement into revenue (and vice versa), funds better services, and stabilises budgets without leaning on blanket fee hikes.

Our insights...

Revenue diversification is moving up on the agenda, with 66% of organisations now looking to broaden their income from just core membership fees.

"In fact, according to MemberWise's Influence 100, subscription fees only cover half an organisation's operational costs. Which is why they highly recommend a portfolio approach to de-risk income." (Propello in, MemberWise, July 2025)

The organisations we spoke to acknowledged the risks of relying too heavily on renewals or other single revenue streams, more so in the face of rising costs and member churn. Also worth noting, organisations currently experimenting with affiliate partnerships, closed user-group discounts, and paid add-ons (like CPD modules and specialist clubs) see diversification as a way to strengthen value; not just financial insurance.

How will membership organisations diversify revenue in 2026?

Investments in revenue diversification are heading mainly toward partners and affiliates, premium tiers, cross-sells and upsells.

-

73% plan to monetise partners and affiliates. Organisations are using reward-programme offers (CPC/CPA) and sponsored content/newsletters to create new income streams.

-

52% will introduce or expand premium tiers. In this capacity, organisations can use tiers to charge more for access to exclusive benefits of higher-value.

-

48% are looking to cross-sell and upsell opportunities. Main points in our discussions were paid add-ons. For example, in specialist clubs an e-learning platform.

-

39% expect more paid events and community formats.

-

15% anticipate broad price increases. This shows favouring towards value-led diversification over across-the-board hikes.

Non-subscription fee revenue streams

The table below highlights practical initiatives that can diversify revenue, reduce financial risk, and create additional value for members.

| Revenue Source | Pros & Cons | Considerations | Example |

|

Training & Certification |

+ Builds authority & credibility + Creates a recurring revenue stream – Requires content expertise |

Needs continual updates to stay valuable | Paid CPD courses or accredited certifications |

|

Events & Conferences |

+ High visibility & sponsorship income + Strengthens community – High upfront and logistical costs |

Hybrid/virtual formats reduce risk and broaden reach | Annual industry summit with paid tickets and sponsorship packages |

|

Partnerships & Sponsorships, Advertising Packages |

+ Generates predictable income + Enhances member value – Risk of poor brand alignment |

Vet partners carefully to ensure mission/values fit | Sponsorship deals with aligned corporate partners |

|

Merchandise & Publications |

+ Builds brand presence + Low-cost add-on revenue – Limited scale potential |

Works best with a highly engaged base |

Selling branded reports, research guides, or merchandise |

|

Affiliate Marketing |

+ Generates commission income + Low overhead to implement – Reliant on affiliate performance |

Can include both affiliate links on your site and commission from rewards programme partners | Affiliate links in newsletters or commissions from retailer sales via the member rewards platform |

Maximising existing membership revenue

Although membership fees shouldn't be the only source of income, they will be a primary source for most membership organisations. However, there are ways to optimise and grow this revenue stream. The table below outlines strategies including tiers, add-ons, and bundles that increase value and income.

|

Revenue Strategy |

Pros & Cons |

Considerations |

Example |

|---|---|---|---|

| Tiered Membership Levels | + Appeals to different budgets + Upsells members into higher value – Risk of excluding lower-income groups |

Ensure each tier has clear, differentiated benefits | Standard, Gold, and Platinum tiers with increasing access |

| Add-On Services | + Generates incremental revenue + Flexible for members – Requires clear communication of value |

Price add-ons fairly and avoid confusing the core offer | Extra cost for access to premium research or specialist clubs |

| One-Off Upgrades | + Quick boost in revenue + Creates exclusivity – Not sustainable if overused |

Use sparingly to avoid member fatigue | VIP event tickets available at additional cost |

| Automatic Renewal / Multi-Year Discounts | + Improves cashflow & retention + Reduces admin costs – May be a barrier for price-sensitive members |

Offer discounts that encourage commitment without eroding overall value | 2-year membership at a reduced annual rate |

| Bundled Packages | + Increases perceived value + Encourages higher spend – Risk of over-complicating choices |

Bundle services that members already value together | Membership + conference pass + publication at a package price |

6) How Will Personalised Experiences Redefine Member Relationships?

Personalisation is moving from aspiration to expectation. Members are used to streaming, retail, and banking platforms that anticipate their needs. They increasingly expect the same from their membership organisation. When communications feel tailored, benefits reflect their stage of life or career, and the timing of offers is spot-on, people feel recognised rather than...processed. That sense of being “known” by the organisation deepens loyalty towards it. That in itself makes value easier to see and turns renewal into the obvious next step.

What are the causes of poor member personalisation?

Personalisation often fails not because organisations dismiss its importance, but because their systems and processes aren’t set up to deliver it. Data is frequently trapped in silos, meaning teams can’t see a complete view of the member. As a result, communications default to generic and neutral messaging. These simply don’t resonate. Some organisations we spoke to acknowledge their own missed opportunities to act in the moment. It's because they lacked behavioural triggers or automated workflows to nudge members at the right time.

-

Siloed systems block joined-up member views

-

Broadcast comms instead of segmented, needs-led journeys lead to generic messaging that doesn't resonate

-

Static benefit bundles rather than flexible options fail to shape desired behaviour at critical stages

-

Lack of triggers or automation to deliver time-bound incentivs often results in missed opportunities

-

Limited testing and iteration due to skills or gaps in the tech stack hold back organisations

Our insights…

Personalisation is firmly on the radar. Going into 2026,

58% of organisations rate it a high priority. The challenge is no longer convincing boards of its importance, but enabling teams to deliver it consistently.

Many recognise that relevance drives engagement, but fragmented systems and legacy platforms still stand in the way.

A handful of frontrunners are moving beyond demographic targeting into behavioural segmentation. Their focus is on using activity signals, lifecycle models and data around preferences to shape content, events and rewards. Organisations who have implemented this are seeing higher engagement rates. The general consensus in feedback from members is that they feel “understood” rather than “marketed to.”

The gap between organisations leading in personalisation and the wider sector is glaringly obvious. Closing it will be critical in 2026 for those organisations that want even a sliver of a chance of reducing churn and securing long-term loyalty.

How are membership organisations delivering personalised experiences in 2026?

Organisations plan to bring personalisation to life in 2026 using five core strategies.

66% will focus on data utilisation. Using behavioural segmentation and value models to deliver 1:1 experiences which are underpinned by integrated systems.

62% are investing in APIs and tech connectivity, creating a single source of truth that powers real-time member experiences.

45% will personalise events and community activity. Designing calendars, seminars, and groups around specific member interests.

38% plan to start early with onboarding. As we've seen in previous examples, clearly communicating organisational benefits captures new members. In terms of personalisation, it presents a chance to understand what new members want and act on that feedback.

35% will fine-tune rewards. AI-supported incentives aligned to past redemptions and personal preferences support personalisation efforts.

These initiatives show personalisation moving from abstract strategy to daily practice. With better data foundations, integrated systems and dynamic benefits, membership organisations can make every interaction feel more relevant, more human and more valuable.

7) Why Are Tech Integration and Digitisation Critical to Membership Growth?

Members expect seamless, mobile-first experiences. Organisations need data flowing across systems to drive engagement, acquisition and retention. Yet for many, legacy tech, clunky user journeys and complex integration hold back progress. Tech integration, the ability to leverage data and mobile-first UX are essential to reduce friction, personalise member journeys and sustain member value.

What causes tech integration challenges?

Barriers aren’t only technical. There's also strategic and operational implications. Organisations know what needs to be done. Unfortunately execution is slowed by resource constraints, competing priorities, and legacy infrastructure. The result is disjointed journeys that frustrate members and weaken conversion.

-

Development bottlenecks where APIs are deprioritised due to limited tech resources.

-

Fragmented systems that prevent data from flowing between CRMs, apps, and rewards platforms.

-

Cumbersome user experiences with too many verification steps or unclear redemption paths.

-

Outdated portal or WebView journeys that feel disconnected compared to modern app-first experiences.

-

Security and compliance concerns slowing down adoption of SSO and token-based authentication.

Our insights...

64% of organisations now rate system integration as a high priority. 56% are focusing on UX and mobile-first delivery.

The gap shows a misalignment. Data is being connected, but the front-end experience isn’t improving fast enough for members to feel it.

How can membership organisations improve mobile UX?

Membership organisations are rethinking mobile user experience to remove friction and make everyday engagement seamless. Four core strategies are emerging:

-

Frictionless sign-up. Many are moving toward password-free logins and pre-defined journeys. This lowers barriers at the very first touchpoint, helping members get started in seconds rather than minutes.

-

Embedding rewards and benefits. Rather than relying on static portals, organisations are integrating rewards and perks directly into member apps. That way, benefits are always visible and accessible where members spend their time.

-

Instant redemption. QR codes, digital wallets, and tap-to-claim functionality are becoming standard. Members expect real-time gratification, and instant redemption keeps rewards relevant and engaging.

-

App-first communities. Portals are giving way to app-first community spaces. These drive daily usage by combining social features, event access and peer exchange in a single, mobile-native environment.

Taken together, these initiatives show a shift toward mobile-first engagement. Membership organisations can make the member experience as smooth and habitual as the consumer apps people use every day by removing friction, embedding value, and prioritising convenience.

Trending Solutions

Moving on from the core priorities that take precedence in our research, we'll now look at other trends to expect in 2026 for the membership organisation sector. Many of these have shown up repeatedly as go-to solutions across a wide range of challenges.

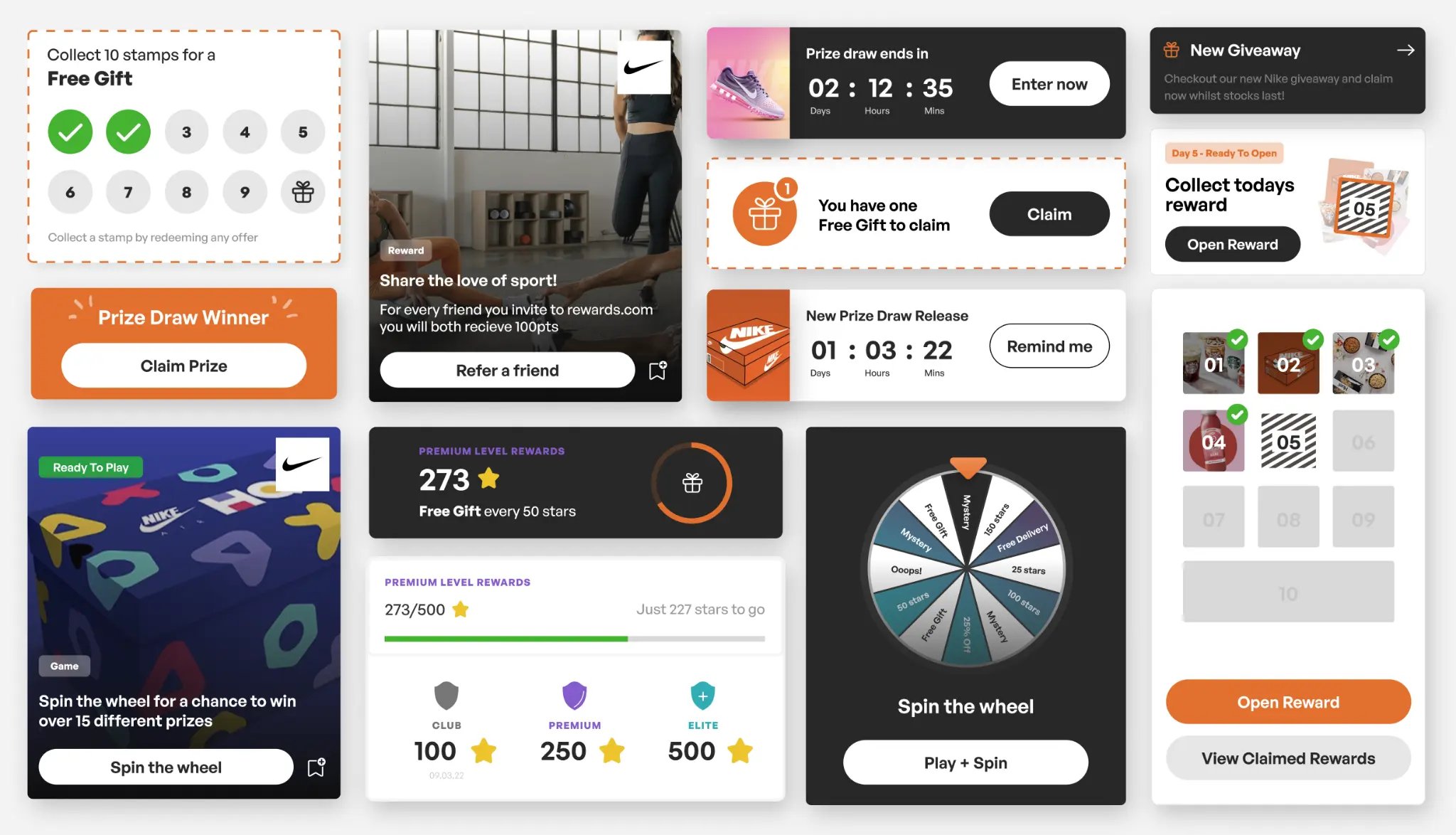

8) How Will Gamification Turn Passive Members into Habitual Participants?

Gamification turns sporadic use into steady participation by making progress fun and rewarding. Actions as small as logging in, completing profile set-up, booking events and completing modules, unlock visible gains and quick payoffs. Members that feel momentum always more often than not come back, try new features, and build routines that last beyond initial novelty. Even better, this scales. Once the mechanics are in place, they keep nudging the right behaviours without needing constant new content or big campaigns.

-

Progress meters and achievement badges

-

Daily/weekly “rhythm” goals with light perks

-

Tasks that unlock benefits as you go

-

Short participation drives (e.g., event sprints)

-

Status steps that open higher-value access

65% of membership organisations are exploring gamification to lift ongoing engagement using consumer-style mechanics (progress cues, instant feedback, quick rewards) to make member areas feel active and worth returning for.

How are membership organisations using gamification in 2026?

Plans focus on making participation feel rewarding in the moment. Teams are adding clear progress cues, pairing priority actions (event attendance, profile completion, CPD) with immediate outcomes, and running short, time-boxed activations to spark revisits. Gentle cadence tools—like weekly goals—build a return habit, while simple status steps open extra benefits over time. The common thread: fast feedback, low friction, and rewards that map to behaviours the organisation values most.

-

Real-time progress and instant acknowledgements

-

Priority-action rewards (events, profiles, learning)

-

Time-boxed reactivation bursts/challenges

-

Weekly-goal cadence to sustain return visits

-

Step-up access: higher tiers unlock as you participate

9) How Can Partnerships Be Leveraged Across the Membership Lifecycle

Partnerships are being embedded across the lifecycle. For revenue, affiliate deals and sponsored content unlock new streams. Co-branded events and content keep members active and engaged between core programmes. Everyday partner discounts help memberships “pay for themselves", boosting retention. In terms of acquisition, joint campaigns and cross-promotion bring in pre-qualified audiences. And for value, partners fund specialist resources and CPD.

| Use Case | % | Example |

| Revenue Diversification | 73% of organisations plan to use partners to diversify revenue. | Affiliate/partner monetisation (CPC/CPA), sponsored content/newsletters, retail media, licensing/reseller models. |

| Engagement | 44% of organisations will increase the use of partners for member engagement. | Co-hosted events, curated closed-user-group offers, partner-funded prize draws/giveaways, content collaborations. |

| Retention | 41% of organisations will leverage the use of partners to drive member retention. | Everyday essentials discounts (supermarkets/fuel), exclusive access, insurance/financial services at member-only rates to offset fees and reduce churn. |

| Value | 33% of organisations plan to partners to enhance member value. | Partner-funded discounts/vouchers plus specialist content, toolkits and reports that extend the value stack. |

| Acquisition | 27% of organisations will increase the use of partners to acquire new members | Co-marketing/reciprocal partnerships widen reach, partner-funded referral incentives, student/corporate routes to reach pre-qualified audiences. |

What are the different partnership types on offer for membership organisations:

Benefit and rewards programmesTwo leading membership organisations (NASUWT and ISM) strengthen member value by combining everyday savings with lifestyle benefits.

NASUWT Gold StarNASUWT (National Association of Schoolmasters Union of Women Teachers) offers its members a multi-partner loyalty programme.

|

Event sponsorshipsEvent sponsorships give membership organisations a powerful way to generate revenue while improving the member experience. Partnering with aligned brands allows you to subsidise or upgrade events, thereby reducing costs and enhancing value for members. Sponsors gain visibility with a targeted audience, and your organisation strengthens its role as a connector between members and the wider industry. Example: National Trust works with corporate partners like Cotswold Outdoor to support conservation, walking festivals and member events. |

Advertising in publicationsAdvertising in membership publications turns existing communication channels into revenue streams. Corporate partners pay to reach a highly targeted audience, while members benefit from relevant offers and industry insights. For the organisation, it monetises existing assets without additional overhead, reinforcing the publication’s role as both an information hub and a valuable platform for engagement. Example: CIPD’s People Management offers advertising across the website, newsletters and events. |

Corporate/strategic partnershipsCorporate and strategic partnerships allow membership organisations to deliver benefits that extend beyond their own resources. By collaborating with aligned companies, they can offer exclusive discounts, services, or insights that enhance membership packages. At the same time, these partnerships generate predictable income for the organisation and foster long-term relationships that strengthen its financial stability.

Example: The Royal Horticultural Society (RHS) partners with brands on long-term sponsorships of gardens and flower shows. |

Sponsored research & campaignsSponsored research and campaigns help membership organisations showcase thought leadership while generating additional income. External partners fund projects that align with shared priorities, such as industry reports or advocacy campaigns. Members benefit from credible insights and representations, while the organisation gains both financial support and increased influence in shaping sector-wide discussions and policies. Example: Trades Union Congress (TUC) collaborates with organisations on campaign activity and publishing |

Training & CPD partnershipsTraining and CPD partnerships expand professional development opportunities without paying the full cost of content creation. Collaborating with trusted providers, they can offer accredited courses or workshops at discounted rates. Members gain access to high-quality education, while the organisation benefits from a new revenue stream and a stronger position as a career development leader.

|

Job board & recruitment advertisingJob boards and recruitment advertising partnerships connect members with career opportunities while driving revenue for the organisation. Employers pay to list vacancies in a trusted, sector-specific space, increasing relevance and visibility. Members benefit from exclusive access to roles aligned with their skills, while the organisation monetises its position as a professional hub and career gateway. |

10) Why Are Referrals a Key Acquisition Channel?

Referrals are one of the most cost-effective ways to acquire new members. Unlike paid campaigns, they convert prospects who already trust the referrer, making them more likely to join and stay. For organisations facing rising acquisition costs and weaker marketing channels, referrals provide a scalable, authentic path to growth; turning satisfied members into advocates who bring in others.

What causes poor referral performance?

Referrals underdeliver when the mechanics are too slow, generic, or poorly promoted. Annual voucher drops don’t create urgency, and flat incentives miss the mark compared to real-time credits or dual-sided rewards. Several organisations admitted their systems made referrals clunky—lacking social sharing, mobile integration, or fraud controls. Without easy tools and instant gratification, referrals risk becoming a vanity project, rather than a core acquisition driver.

-

Incentives that arrive too late or feel underwhelming

-

One-sided rewards that don’t benefit both referrer and friend

-

Referral journeys hidden deep in platforms, not visible in-app or mobile

-

Lack of social sharing integrations (WhatsApp, Facebook, etc.)

-

Weak fraud prevention leading to abuse or mistrust

Our insights…

Referrals consistently outperform traditional channels on cost and conversion.

Our research shows 49% of membership organisations are considering or reviewing their referral programmes.

This reflects the growing recognition that acquisition isn’t just organic, it can be engineered with the right tools and incentives.

How are membership organisations using referrals in 2026?

Our research shows organisations are making referrals central to acquisition by modernising tools and incentives. Many are introducing dual-sided offers where both referrer and referee benefit i.e., credits, free months, cash rewards. Real-time fulfilment is replacing delayed vouchers, with platforms issuing instant credits or discounts. Integrations with apps and social channels make referrals frictionless, while gamified campaigns (bonus points for five referrals, milestone rewards, etc.) add momentum. Finally, GDPR-compliant systems with fraud controls build on trust and sustainability.

-

Dual-sided incentives like credits, free months, or vouchers

-

Real-time credits replacing slow annual voucher drops

-

Integrated referral tools within apps and member portals

-

Social sharing via WhatsApp, Facebook, and in-app links for easy promotion

-

Gamified and tiered rewards such as £50 per referral or £500 for five

Adopting all of these approaches will turn referrals from static back-page features into dynamic, always-on acquisition engines.

11) Why Are Events & Community a Core Engagement Lever?

Events and community initiatives are one of the strongest drivers of belonging. Unlike discounts or static benefits, they create shared experiences, relationships, and professional growth that members can’t easily find elsewhere. Our research shows organisations are investing here, with 30% engagement-focused, 33% retention-focused, and 36% member value-focused. Clearly, events and community are a cross-cutting priority for acquisition, engagement, and retention alike.

What causes weak event & community engagement?

Events and community efforts underperform when they are treated as bolt-ons. Too often, organisations focus on headline conferences or annual gatherings without sustaining interaction year-round. Communities can also struggle when they lack facilitation, feel generic, or fail to deliver value beyond conversation. Our research highlights several recurring challenges:

-

Over-reliance on large annual events with little follow-up

-

Communities launched without moderation, structure, or active facilitation

-

Poor digital experiences that make forums clunky or inaccessible

-

Lack of integration between events, community, and other engagement channels

Our insights…

Organisations that succeed design events and communities as ecosystems — mixing flagship conferences with regular micro-events, online workshops, and always-on forums. They combine this with tools that target non-attenders and encourage exploration. As one told us: “Loyalty functionality allows targeting cohorts…incentivise members who have not attended events to participate.”

Our research shows organisations are actively investing in events and community initiatives, reflecting the recognition that belonging is one of the stickiest forms of member value.

This reflects a recognition that shared experiences drive loyalty, advocacy, and retention in ways other channels cannot.

How are membership organisations using events & community in 2026?

Organisations are evolving their approach by blending in-person, digital, and community-first models. Instead of isolated events, they’re building ecosystems of engagement where members can connect, learn, and share year-round. Key strategies include:

| Use Case | % | Example |

|

Member acquisition |

32% |

Member open days; Virtual meet ups & micro-events as low-barrier tasters; interactive content (live polls/Q&A) during open sessions; always-on community spaces with guest access; tiered event access with pre-sale invites for prospects; CPD taster workshops. |

|

Member Engagement |

30% |

Seasonal micro-events to build cadence; tiered event access (VIP lounges/premium sessions); online member community platforms to keep conversations active between events; progress-linked educational tracks to sustain momentum. |

|

Member Retention |

33% |

Member-only tiers at events (VIP areas, pre-sales) as renewal perks; micro-communities that deepen belonging; CPD milestones proving ongoing value; interactive sessions that recognise long-tenure members. |

|

Member value |

36% |

Educational programmes mapped to qualifications; always-on community for peer support and mentoring; tiered event access that unlocks premium experiences; virtual meet ups for frequent, practical value; interactive formats to surface member wins and feedback. |

|

Personalised member experience |

45% |

Interest-based micro-events and community groups; targeted educational pathways with CPD recognition; interactive Q&As tailored to cohort needs; tiered access reflecting status/tenure; always-on platforms with curated feeds by role/interest. |

|

Revenue diversification |

39% |

Paid events or Premium/paid event tiers (VIP bundles, pre-sale upgrades); sponsored micro-events and workshops; paid educational programme with accreditation; community subscriptions for specialist groups. |

Combining these tactics, organisations are turning events and communities from occasional touchpoints into continuous engagement engines. Members should connect, learn and share week by week, building a sense of belonging that drives loyalty and retention.

12) Why Are Tiers a Core Engagement Strategy?

Tiers give members visible progression, status, and exclusivity. As we've already seen, unlike flat models — where every member gets the same benefits — tiers reward loyalty, incentivise upgrades, and make participation feel part of a journey. Out of the organisations we spoke to, 63% are focusing on tiers for engagement, 69% for retention, and 33% on value. These investment patterns have shown tiers to be one of the most widely adopted levers across the lifecycle.

When tiers don't work

Tiers can fall flat when they are poorly structured or overly complex. If members can’t see what they gain from moving up, or if the value gap between free and paid feels too narrow, adoption stalls. Similarly, if tiers are just “labels” without meaningful differences, members disengage. From our analysis, recurring pitfalls include:

-

Free tiers that capture sign-ups but fail to convert to paid

-

Premium tiers that don’t offer clear, aspirational benefits

-

Confusing or opaque rules for progression

-

Gated content that feels punitive rather than rewarding

-

Over-reliance on discounts instead of diverse, high-value perks

Our insights…

Organisations that succeed with tiers design them as ladders of value: free entry points to widen the funnel, gated milestones that reward consistent activity, and premium tiers that create aspiration.

Organisations are building or expanding tiered models, reflecting a growing recognition that progression and exclusivity drive long-term stickiness.

How are membership organisations using tiers in 2026?

Organisations are taking a conscious decision of moving from static price bands into dynamic engagement journeys. Members are not just paying more for the sake of it. Progression, reward unlocks, and achieving higher status, strengthen their loyalty and reduces the chance of churn.

| Use Case | % | Example |

|

Retention |

69% of organisations plan to use tiers to drive retention |

Status-only benefits, renewal accelerators, rolling qualification, save offers for at-risk tiers, priority service. |

|

Engagement |

63% plan to use tiers to boost engagement |

Milestones and streaks, tier locked perks, seasonal achievements, simple challenges, visible progress cues. |

|

Revenue diversification |

52% plan to use tiers to diversify revenue |

Paid premium tiers, dual pricing for members and VIP bundles. |

|

Member value |

33% plan to use tiers to enhance value |

Tier based discounts and rates, premium content and tools, service upgrades, early access, concierge support. |

|

Member acquisition |

29% plan to use tiers for acquisition |

Free entry tier with upgrade path, trial to paid upgrade, starter boosts to reach first tier, referral fast track to higher status. |

13) Why Are Rewards a Core Growth & Engagement Lever?

Rewards create immediate reasons to act, from joining and logging in to attending, learning, referring, and renewing. Unlike static perks, conditional rewards unlock only when members complete meaningful actions, aligning value with behaviour.

In our research, rewards emerge as a cross-journey lever: 58% of engagement-focused organisations use them to reinforce target behaviours; 46% of retention-focused programmes use them to lift renewals and curb churn; 44% position everyday savings as tangible member value; 38% personalise incentives to preferences and context; and 22% deploy non-referral sign-up incentives to drive acquisition.

What causes weak reward performance?

Rewards underdeliver when they’re front-loaded, slow, or generic, or when costs aren’t controlled. Common pitfalls we observed:

-

One-off welcome perks with delayed fulfilment (e.g., slow voucher drops) that fail to build habits.

-

Generic or one-sided incentives that feel unfair or irrelevant.

-

Over-discounting at acquisition that spikes early sign-ups but drives later drop-off (e.g., concern raised at Numan).

-

Poor visibility in-app or journeys hidden behind logins with no prompts to engage.

-

Lack of fraud controls and measurement, making ROI unclear.

-

No staging or expiry rules, so value is claimed without meaningful action.

Our insights…

Programmes that win make rewards conditional, staged, and visible: instant credits over delayed vouchers; dual-sided incentives where both the member and the invitee benefit; partner-funded offers to widen variety without ballooning costs; and data-driven targeting to put the right nudge in front of the right cohort at the right time.

Rewards show up across the lifecycle in our data: Engagement 58%, Retention 46%, Member Value 44%, Personalisation 38%, and Acquisition 22%.

How are membership organisations using rewards in 2026?

Organisations are moving from blanket perks to conditional, real-time, and personalised incentives. We see five dominant patterns:

| Use Case | % | Example |

|

Member acquisition |

22% |

Acquisition incentives like welcome packs, credits, upfront discounts, and giveaways; first-purchase value to prove proposition quickly; time-based hooks (e.g., free box after 3 months) to convert fence-sitters. |

|

Member value |

44% |

Everyday savings via closed-user-group discounts, cashback, and lifestyle perks; tier-based offers that make membership cost-neutral; dual pricing and premium perks to bank value month-to-month. |

|

Member Retention |

46% |

Renewal credits and milestone unlocks; time-boxed offers to curb early churn; attendance-driven rewards; win-back campaigns with targeted discounts; loyalty tracks to extend tenure. |

|

Member Engagement |

58% |

Gamified rewards paired with progress cues; conditional incentives tied to priority actions (profile completion, event attendance); campaign-led unlocks like prize draws and challenges; status-linked benefits to sustain usage. |

|

Personalisation |

38% |

Data-driven incentives based on cohort, locale, or behaviour; segmentation (e.g., parents vs teens, branches, tiers); location-based offers; progress-led targeting for specific areas; tailored content unlocks tested for impact. |

Other Emerging Trends

Outside of our own research, we've also identified other trends during interactions with the membership organisation sector.

14) Is AI Now Mandatory for Effective Membership Management?

100% of membership bodies agree that the influence of AI on memberships will grow in the next three years. Yet, only 16% of associations feel “ready” for future tech demands.

Initially this may seem concerning but it opens a world of possibilities for forward-thinking organisations. Exploration of AI use cases in membership management continues to grow. The associations driving this exploration are improving their operational efficiency, member retention, and engagement rates.

Where does AI have the greatest impact for membership organisations?

-

Member support automation offers instant responses to basic queries 24/7

-

AI-driven loyalty programmes can serve relevant rewards to members based on their past redemptions and behavioural data.

-

Predictive member analytics identifies the content that will resonate with specific member groups

-

Content personalisation engines tailor content (emails, newsletters, etc.) according to members’ reading history and click patterns

-

Immersive experience platforms offer virtual networking and training events

-

Smart onboarding workflows adjust the pace and complexity of the signup process depending on engagement level and completion rate

While the remaining 84% of associations try to catch up, early adopters are already creating memorable member experiences. They’re delivering the exceptional value proposition that members expect and deserve.

15) How Are Demographic Shifts Reshaping Membership Strategies?

In the UK, Millennials and Gen Z now make up most of the workforce, but are you speaking their language? If your answer is no, you’re missing out on massive potential in these younger generations.

"Membership organisations – and professional bodies in particular – are under increasing pressure from shifting demographics, changing expectations, and growing competition from digital platforms.

Younger members demand AI-driven, flexible, digital-first offerings that provide immediate value."

(Mustard Research)

Despite barriers to engage and recruit younger demographics, such as providing digital-first experiences and re-evaluating your entire value proposition, the sheer potential of this market means that it will be a focus for membership organisations for the rest of 2025 and into 2026.

What are the key steps to take in engaging younger members?

|

Understanding your audience: Collate preferences through surveys, feedback, and monitoring social channels. Insights into younger members’ needs help shape services that resonate. |

|

Digital transformation: Younger members also expect a strong digital presence — from user-friendly websites to meaningful interaction via social media. Content should reflect generational preferences: image-led for Millennials, video and interactive formats for |

|

Flexibility is non-negotiable: With subscription models dominating their daily lives, rigid membership structures risk alienating digital natives. Offering variety, adaptability, and personalised options will encourage uptake and retention. |

|

Community-building is vital: Younger members seek purpose-driven spaces where they can share values, grow their networks, and progress their careers. Delivering on these expectations can transform membership organisations into vibrant, future-focused communities. |

Engaging the Next Generation: Tips for Membership Organisations to Attract Younger Demographics

Ready to Stop Playing Catch-up?

The membership ecosystem will continue to evolve. Thriving organisations monitor changing membership trends and take proactive steps to provide ongoing value for their members.

Join their ranks today by:

-

Embracing real-time engagement and rewards programmes that scale value delivery and prioritise your members’ needs

-

Personalising the member experience to boost participation and long-term loyalty

-

Diversify your revenue streams before economic shifts force your hand

-

Build inclusive, tech-driven micro-communities where members can connect, collaborate, and learn from each other

Start acting on these trends today, and you could lead your industry next year.

FAQs

What are the biggest challenges for membership organisations in 2026?

Falling member engagement, rising acquisition costs, and weak retention dominate. Members expect mobile-first, real-time engagement and personalised experiences. Clearer membership value propositions and digital transformation are vital to sustain long-term growth and trust

Which strategies most improve member retention?

Document an engagement strategy, then layer gamification, tiered membership, and behaviour-linked rewards. Use data analytics to flag churn, trigger timely saves, and quantify value. Always-on online communities and hybrid events deepen belonging and lift renewals and lifetime value.

What’s the fastest way to boost member engagement?

Reduce friction and offer flexibility: mobile-first journeys, passwordless sign-in, and in-app rewards. Run micro-communities, interactive content, and hybrid and virtual events. Use real-time engagement nudges and cohort targeting to keep members engaged between major touchpoints.

How should organisations personalise experiences at scale?

Blend declared preferences with behavioural signals to segment journeys. Trigger AI-powered recommendations for content, events, and rewards in real time. Personalise onboarding and renewal prompts. Measure lift with data analytics, member feedback, and controlled experiments.

How can events and community enhance outcomes?

Blend in-person, hybrid events, and virtual events with always-on forums. Use live polls and Q&A to convert content into interaction, and curate networking opportunities by interest. Track participation to improve member learning, professional development, and overall satisfaction.

What role do partnerships play across the lifecycle?

Partners extend revenue streams and membership value propositions. Co-marketing aids membership acquisition, while partner perks and CPD deepen engagement. Sponsored content supports content creation, and data sharing improves targeting

What metrics best evidence ROI for leadership?

Track active users, repeat logins, event attendance, course completions, and referral rate. Link these to renewals, NPS, and lifetime value. Attribute gains to interventions using A/B tests, predictive analytics, and cohort reports to prove how engagement drives retention and revenue.

Which emerging technologies are worth piloting now?

AI-powered personalisation, augmented reality for training, and mobile wallet passes for instant redemption. Explore community platforms supporting micro-communities and social media integration. Prioritise secure APIs and single sign-on to unify membership sites and improve reliability.

Author Bio, Written By:

Mark Camp | CEO & Founder at PropelloCloud.com | LinkedIn

Mark is the Founder and CEO of Propello Cloud, an innovative SaaS platform for loyalty and customer engagement. With over 20 years of marketing experience, he is passionate about helping brands boost retention and acquisition with scalable loyalty solutions.

Mark is an expert in loyalty and engagement strategy, having worked with major enterprise clients across industries to drive growth through rewards programmes. He leads Propello Cloud's mission to deliver versatile platforms that help organisations attract, engage and retain customers.

.png)

.png)